|

Disclosure of Green Banking Issues

in the Annual Reports: A Study on

Bangladeshi Banks

Dewan

Mahboob Hossain

Ahmed Talib

Sadiq Al Bir

Kazi Md. Tarique

Abdul Momen

International

Islamic University Malaysia

Correspondence:

Dewan Mahboob Hossain

Associate

Professor; Department of Accounting

& Information Systems;

University of Dhaka; Dhaka, Bangladesh.

&

PhD Student

Department of Accounting

International Islamic University Malaysia

Email: dewanmahboob@univdhaka.edu

Abstract

These days, the concept of green banking

is becoming popular in the financial

sectors. This paper deals with the

reporting on green banking issues

by the banking companies in a developing

country - Bangladesh. Through content

analysis of the annual reports of

ten sample banks, the research finds

that Bangladeshi banks are reporting

on green banking issues even in the

absence of any specific reporting

guideline. The nature of the language

used for green banking reports was

also analyzed through discourse analysis.

It was found that after the introduction

of the green banking program of Bangladesh

Bank (the central bank of Bangladesh)

in 2011, the banks started reporting

on their green banking activities.

The level of disclosure increased

over the years up to 2013. The study

concludes that though the banks started

reporting on this issue, their reports

lack consistency because of the absence

of a standardized reporting guideline.

They wanted to report that they are

performing according to the suggestions

of Bangladesh Bank. From this, it

can be said that the banking companies

consider the central bank as a powerful

stakeholder. The banks mostly provided

'good news' in their reports. This

kind of reporting helps the banks

to gain greater legitimacy in the

eyes of the regulator, Bangladesh

Bank, and to the public.

Key words: Green banking, social

and environmental reporting, content

analysis, banks, Bangladesh.

Green Banking: An

Introduction

Today's world is suffering from the

problems arising from global warming,

climate change and massive environmental

pollution. In many ways, issues like

massive industrialization, modernization

and unplanned urbanization are treated

as the main causes of these problems.

It is said that because of this environmental

pollution and climate change, human

existence in this world is becoming

threatened. Because of this environmental

pollution the temperature of the world

is increasing, world climate is changing,

rainfall and crop production are being

affected, and the livelihood of many

marginal groups of people is being

shaken.

It is important to mention here that

over the years, the corporate houses

all over the world are blamed as one

of the contributors to climate change

and global warming. At first, the

manufacturing companies were mainly

blamed for all this. But these days,

even the service oriented organizations

are being blamed for contributing

negatively to climate change. In the

operation of an organization, many

activities are performed that can

affect the environment. While performing

their operating activities, they use

electricity, fuel, gas, water, paper

and others. Other than these, banking

and other financial institutions are

funding several organizations that

are responsible for polluting the

environment.

This paper deals with the issue of

reporting on environmental responsibility

from the banking companies' side.

The main objective of this paper is

to investigate the nature of disclosure

of green banking issues in the annual

reports of Bangladeshi banking companies.

In order to operate in a responsible

manner, banks and other financial

institutions must be aware of their

environmental responsibilities. It

is to be remembered that their activities

must not create any harm to the environment

directly or indirectly. For the purpose

of creating this awareness, the concept

'green banking' came into existence.

Meena (2013: 1181) sees green banking

as an 'initiative for sustainable

development'. Different authors have

defined the term green banking in

different manners. Some of these definitions

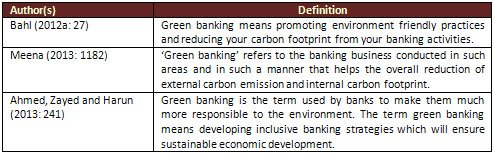

are presented in Table 1:

Table 1: Definitions of Green Banking

If these definitions can be analyzed,

it can be found that the issues like

carbon emission/footprint and sustainability

are the main themes in green banking.

Here, it can be said that the term

green banking came into existence

because of the recent popular environmental

discourses like sustainability, climate

change, global warming, carbon emission

and some others.

Green banking is an attempt to ensure

that the banking activities do not

contribute to environmental pollution.

Many activities are suggested in order

to ensure the achievement of the objectives

of green banking.

For example, green banking encourages

activities that ensure using less

paper (Meena, 2013). This can be ensured

by introducing online banking. Online

banking ensures using less paper work

and thus prevents wastage of paper.

Another important activity is to introduce

green banking products. Bahl (2012a:

27) gave some examples of green banking

products like 'green mortgages', 'green

loans', 'green credit cards', 'green

saving accounts', 'green checking

accounts', 'mobile banking' and others.

Bahl (2012b) mentioned some strategies

that the Indian banks have adopted

in order to ensure green banking.

These are: introducing green banking

financial products, introducing paperless

banking, creating energy consciousness,

using mass transport and green building

and promoting social responsibility

services.

Meena (2013) identified four benefits

of green banking. Firstly, as mentioned

earlier, by ensuring less use of paper

through introducing online and SMS

banking services, green banking helps

in reducing deforestation. Papers

are products of woods and trees. Less

deforestation ensures cooler weather

and thus less contribution to global

warming and climate change. Secondly,

green banking helps in creating environmental

awareness among employees and customers.

Meena (2013) mentions that these awareness

creation activities also help in building

a positive image about the bank among

the stakeholders. Thirdly, green banking

attempts to ensure providing loans

at a lower rate. Green banking programs

encourage setting up environmentally

friendly businesses by providing the

facility of lower interest rates of

loans. Under a green banking program,

the bank shall provide loans with

lower interest rates in case of investment

in 'fuel efficient vehicles, green

building projects' and others. Fourthly,

banks under green banking programs

introduce environmental standards

for lending. It compels the business

houses to change their business activities

in a manner that is environmentally

friendly (Meena, 2013). Thus, negative

impact on the environment is reduced.

Over the last few years, the issue

of green banking gained popularity

in some parts of the world. For example,

articles like Bahl (2012a), Bahl (2012b),

Bhardwaj and Malhotra (2013) and Meena

(2013) highlighted the green banking

practices in India. Papastergiou and

Blanas (2011) investigated the green

banking practices in Greece.

Ahmed, Zayed and Harun (2013) examined

the factors that are responsible for

the adoption of green banking practices

by the commercial banks of Bangladesh.

By conducting a survey among 300 bank

employees and applying factor analysis,

the research found that the main factors

behind this adoption of green banking

practices are 'policy guideline, loan

demand, stakeholder pressure, and

environmental interest, economic and

legal factors' (Ahmed, Zayed and Harun,

2013: 241).

The issue of green banking has become

a catchphrase in the Bangladeshi banking

sector over the last three years.

Bangladeshi banks are emphasizing

on green banking mainly because of

the encouragement and pressure from

the central bank of Bangladesh - Bangladesh

Bank (Ahmed, Zayed and Harun, 2013).

In February 27, 2011, Bangladesh Bank

issued a circular (BRPD Circular No.

2) where it asked the banks of Bangladesh

to adopt a green banking policy in

order to conserve and protect the

environment. Later in July 22, 2012,

Bangladesh Bank issued BRPD Circular

Letter No. 07 that again contained

several guidelines for the banks in

terms of green banking. Finally, in

September 11, 2013, Bangladesh Bank

issued another GBCSRD Circular Letter

No. 05 titled 'Policy Guidelines for

Green Banking' where detailed policy

guidelines along with reporting guidelines

are presented.

In these circulars, Bangladesh Bank

highlighted the issue of climate change

and its negative impact on the environment.

Bangladesh Bank also mentioned the

importance of low carbon industries

for safeguarding the planet. The bank

recognizes Bangladesh as one of the

most vulnerable countries that is

facing challenges because of climate

change and global warming. That is

why Bangladesh Bank called for the

adoption of green banking policies

by the banks of Bangladesh.

It is to be mentioned here that Bangladesh

Bank asked the banks operating in

Bangladesh to adopt the green banking

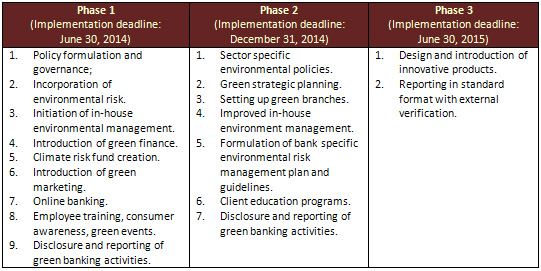

programs in three phases. Table 2

describes these phases.

Table 2: Phases of Implementation

of Green Banking Program Suggested

by Bangladesh Bank (Prepared from

GBCSRD Circular Letter No. 05)

This table reveals that in all

three phases, disclosure and reporting

on green banking was emphasized. But

it should also be noted that the deadline

for the implementation of the first

phase was June 30, 2014. It is to

be mentioned here that over these

three years, the deadlines changed.

In the first circular, Bangladesh

Bank did not provide enough guideline

on the reporting on green banking.

But in terms of reporting, the banks

of Bangladesh responded very quickly.

They went for disclosure on this issue

by creating their own format.

This paper deals with the reporting

of green banking issues by the Bangladeshi

banks. The main objective of this

research is to investigate the nature

of voluntary disclosure on green banking

by the banks of Bangladesh from the

year of 2011 to 2013. The study also

investigates the nature of the language

of this kind of disclosure. It is

expected that from this analysis,

the influence of Bangladesh Bank's

proposed green banking guidelines

on the corporate environmental disclosure

will be identified.

The next section of this article reviews

the prior research on social and environmental

reporting practices in Bangladesh.

After that the theoretical perspectives

of this research is presented. The

methodology of this research is presented,

then the article presents the findings

of this research.

Social and Environmental Reporting

in Bangladesh: Prior Research

Hossain (2014) mentioned that

the first article on social and environmental

reporting practices in Bangladesh

was Chowdhury and Chowdhury (1996).

In this research it was identified

that some companies started social

and environmental reporting on a voluntary

basis. Later Bala and Habib (1998),

Belal (1999), Imam (2000), Belal (2001)

and Hossain, Salat and Amin (2005)

also examined the reporting on corporate

social responsibility practices by

the Bangladeshi companies. In these

studies, it was found that at that

time some companies were disclosing

information on their social and environmental

performances at a minimum scale. They

were disclosing information on environmental

issues, employees and some ethical

issues. It is important to mention

here that all of these studies focused

both on social and environmental issues.

The two earlier studies that concentrated

only on corporate environmental reporting

were by Khan and Hossain (2003) and

Bala and Yusuf (2003). Both of these

studies concluded that the level of

environmental disclosure was minimum.

Almost all of these studies concentrated

on conducting a content analysis of

the annual reports of Bangladeshi

companies. These studies were relatively

small scale and applied simple methodology

(Hossain, 2014).

Later Belal and Owen (2007) and Islam

and Deegan (2008) by conducting both

content analysis and interview method,

made an attempt to identify the corporate

motives behind social responsibility

reporting. It was found that pressure

from parent companies and international

buyers acted as some of the pressure

groups behind corporate disclosure.

Islam and Mathews (2009) and Islam

and Islam (2011), by conducting content

analysis based case studies identified

that negative media coverage can influence

the level of corporate social and

environmental disclosure.

Studies such as Khan, Halabi and Samy

(2009), Sobhani, Amran and Zainuddin

(2009) and Azim, Ahmed and Islam (2009)

found that in comparison to the global

context, the social and environmental

disclosure level of Bangladeshi companies

is low. Azim, Ahmed and Islam (2009)

found that most of the disclosures

are qualitative in nature. Belal and

Cooper (2011) by conducting semi-structured

interviews on NGO managers found that

the main reasons for low level of

disclosure are: 'scarce resources,

profit focus, absence of legal requirements,

lack of knowledge and awareness and

the fear of negative publicity' (Hossain,

2014: 14).

Some studies that made an attempt

to identify the determinants of corporate

social responsibility reporting are:

Rashid and Lodh (2008), Khan, Muttakin

and Siddiqui (2013) and Muttakin and

Khan (2014). Khan, Muttakin and Siddiqui

(2013) found a positive significant

relationship between corporate social

disclosure and the variables like

public ownership, board independence

and presence of audit committee. According

to the study of Muttakin and Khan

(2014), corporate social disclosure

has a positive significant relationship

with 'export-oriented sector, firm

size and types of industries' (Hossain,

2014: 16).

From this discussion it can be seen

that most of the studies focused both

on social and environmental issues

combined. Very few studies investigated

only environmental issues separately.

Though according to Mathews (1997),

in the studies based on Western economies,

environmental issues got more focus

than the social issues; the situation

regarding Bangladesh was different.

One of the recent studies that focused

on only environmental issues is that

of Belal et al (2010). This study

investigates the environmental and

climate change disclosures and conducted

content analysis of annual reports

and web sites of the companies. The

findings of this study resemble those

of the other studies regarding social

and environmental reporting of Bangladeshi

companies. It was found that the level

of disclosure is low. Moreover, the

sample companies in this study disclosed

only the good news.

Very few studies were conducted on

any particular business sector. Even

then, the banking industry got some

importance. Khan, Halabi and Samy

(2009), Khan (2010) and Khan et al

(2011) investigated social disclosure

of the banking companies. Khan, Halabi

and Samy (2009) concluded that 'the

extent of CSR reporting of Bangladeshi

companies is not satisfactory and

the users expect more CSR disclosure'

(Hossain, 2014: 13). The study conducted

content analysis of the annual reports

of the banking companies along with

a perception survey among the users.

Khan (2010), by applying multiple

regression method investigated whether

there is any influence of corporate

governance components on CSR disclosures

in the case of banking companies of

Bangladesh. In this study the non-executive

directors and the existence of foreign

nationalities were identified as significant

determinants. Khan et al (2011) examined

the extent of corporate sustainability

reporting of the commercial banks

of Bangladesh. The extent of reporting

was measured according to the guidelines

of Global Reporting Initiatives (GRI).

It was found that though Bangladeshi

commercial banks report on many social

issues, the issues like product responsibility

and human rights get less importance.

This study contributes to the literature

of corporate social and environmental

reporting of Bangladesh by highlighting

a new issue - disclosure of green

banking. Also, no prior research conducted

a discourse analysis of the corporate

narratives related to social and environmental

issues. Another novelty of this study

is that it considers the effect of

a particular guideline from a powerful

agency - the central bank - on the

environmental disclosure by Bangladeshi

banks.

Theoretical

Framework

This research focuses on the issue

of corporate social and environmental

reporting. Research on social and

environmental accounting and reporting

started in the early 1970s (Mathews,

1997). That means social and environmental

accounting research, at this moment,

has a history of more than 40 years

(Hossain, 2014). Over the years the

researchers have produced a huge amount

of research on this topic. At the

beginning, the researchers mostly

concentrated on the social and environmental

reporting practices of the companies

in the developed economies, and at

that time the companies in the developing

and underdeveloped economies got less

attention from the researchers' part

(Islam, 2010 and Hossain, 2014). Mainly

from the last decade, research on

social and environmental reporting

practices of the companies in developing

and underdeveloped countries started

getting researchers' attention.

Over the years, stakeholder theory

and legitimacy theory remained as

the most popular theories for the

researchers in explaining the scenario

of corporate social and environmental

reporting practices. Both these theories

explain the reason behind this kind

of voluntary disclosures from the

corporations' part.

Stakeholder theory states that corporations

have to deal with a diverse range

of stakeholders. In the past it was

believed that organizations have to

deal mostly with the shareholders

as they are the main fund providers.

This shareholder perspective has changed

over the years. These days it is thought

that other than the shareholders there

are other stakeholders like employees,

industry bodies, consumers, media,

government, suppliers, interest groups

and the public (Deegan and Unerman,

2006). It is believed that as a part

of the society, business organizations

'can affect a society in many ways'

(Alam, 2006: 208). Social and environmental

activities of a business can affect

several groups in the society both

directly and indirectly. That is why

it is important that businesses do

not perform any activity that becomes

harmful for this diverse range of

stakeholders. Business and the society

are interdependent. On one hand, society

has to depend on business for the

products and services. On the other

hand, in order to survive, businesses

have to deal with the society. It

is the people in the society who purchase

and consume the products of the business

and thus the survival of the business

is ensured. That is why business must

act in a responsible manner so that

the interest of the society (consisting

of a diverse range of stakeholders)

is upheld. In corporate social and

environmental reporting literature,

it is highlighted that the companies

should not only act in a responsible

manner, but also report on their activities

to these stakeholders. That means

the company should be accountable

to the society.

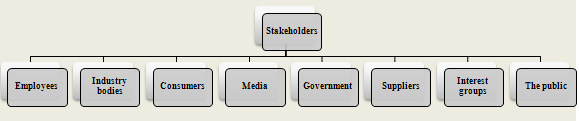

Figure 1: Stakeholder Groups (Deegan

and Unerman, 2006)

Stakeholder theory has two branches:

ethical branch and managerial branch.

There is no doubt that it is difficult

to maintain and uphold the interests

of all the stakeholders mentioned

above. Another issue is the power

of the stakeholders. It is also true

that all these stakeholders do not

have similar power to influence the

organizational activities. So, the

question comes whether an organization

should place equal importance on all

these stakeholders or not. The ethical

branch of stakeholder theory states

that all these stakeholders have their

rights and thus their rights should

not be violated (Deegan and Unerman,

2006). In this case, from a reporting

perspective, the management should

try to fulfill the information needs

of all these stakeholders in an efficient

manner.

But the managerial branch of stakeholder

theory states that corporate management

is more likely to meet the needs of

more powerful stakeholders first.

That means, management may behave

strategically and fulfill the needs

of the more powerful stakeholders

in a more efficient manner. Management

may rank the stakeholders according

to their power. In case of reporting,

management may make an attempt to

fulfill the information needs of mostly

the powerful stakeholders.

Another important theory in corporate

social and environmental accounting

research is the legitimacy theory.

It was mentioned earlier that in order

to survive an organization has to

deal with the society and with the

people of the society. An organization

cannot survive in the society without

the approval of the people in the

society or community. Here comes the

issue of legitimacy. If the society

does not consider the activities of

the business organization as legitimate,

the business cannot operate in the

society. If the organization works

against the interests and values of

the society, its existence will be

at stake. It is therefore important

that the perception of the society

about the organization remains good.

In this respect:

"Legitimacy theory asserts

that organizations continually seek

to ensure that they are perceived

as operating within the bounds and

norms of their respective societies,

that is they attempt to ensure that

their activities are perceived by

outside parties as being 'legitimate'".

(Deegan and Unerman, 2006: 271)

Any wrongdoing from the part of the

organization or any bad news about

the organization can create a 'legitimacy

gap' which may appear to be harmful

to the organization. A legitimacy

gap can even result in winding up

of the company. A bad/wrong perception

about the company can lead the consumers

to boycott their products. So, in

many ways, a legitimacy gap can appear

as harmful for the existence of the

company.

That is why the companies try to manage

their impression in the eyes of the

society. One of the tools for managing

impression and maintaining legitimacy

is corporate reporting. By reporting

on their activities in a positive

manner, companies can gain legitimacy

for their activities.

Stakeholder theory and legitimacy

theory interrelate in a way that at

the end the activities of the company

have to be legitimate in the eyes

of the stakeholders who get affected

by the affairs of the company.

These days, environmental issues have

become a global concern. A wider range

of stakeholders get affected by environmental

pollution. If organizational activities

harm the environment in any way, organizational

legitimacy may be threatened and legitimacy

gap may come into existence. The way

to minimize the legitimacy gap is

environmental reporting. If companies

can create an image that their activities

are environment-friendly, through

environmental reporting, legitimacy

is achieved.

Methodology

This research firstly applied

content analysis method. Over the

years, this method remained one of

the most popular choices among the

social and environmental accounting

researchers. Content analysis can

be defined as 'a careful, detailed,

systematic examination and interpretation

of a particular body of material in

an effort to identify patterns, themes,

biases and meanings' (Berg and Lune,

2012: 349). Here, in this research,

the particular body of material that

is analyzed is the annual reports

of the banking companies of Bangladesh.

Annual reports of the top ten banks

(among total 30 banks listed in the

Dhaka Stock Exchange) selected on

the basis of the total assets in 2011,

were taken for analysis. For each

bank annual reports of 2011, 2012

and 2013 (three years, 30 annual reports

in total) were selected. It was mentioned

earlier that in the year 2011 Bangladesh

Bank introduced the concept of green

banking to the banking sector of Bangladesh.

It is expected that the banking companies

that are bigger in size will try to

go for more voluntary disclosure and

continue to increase it over the years.

Before this, many other researchers

hypothesized that the firms that are

bigger in size will go for greater

voluntary disclosure (see Spicer,

1978; Patten, 1991; Gray, Javad, Power

and Sinclair, 2001; Roberts, 1992;

Prado-Loranzo et al, 2009; Freedman

and Jaggi, 2005). One common measure

of firm size is total assets (Ousama,

Fatima and Hafiz-Majdi, 2012). So,

it can be said that the sample selection

criteria is consistent with previous

research on voluntary disclosure.

The annual reports were collected

from the respected websites of the

banks. Among the top ten banks on

the basis of total assets in 2011,

three did not have all three year's

(2011 to 2013) annual reports in their

web sites. As a result, 10 banks among

the top 13 had to be selected as a

sample.

After collecting the annual reports,

these were examined in order to identify

the several green banking issues that

were disclosed. From 2011, all the

sample banks started reporting under

the heading of 'Green Banking'. So,

the contents under this heading were

analyzed. In 2013, through GBCSRD

Circular Letter No. 05 titled 'Policy

Guidelines for Green Banking', Bangladesh

Bank has clearly given the issues

that need to be disclosed by the banks

in respect of green banking. By keeping

these issues in mind, the content

analysis was conducted. It was seen

that the sample banks, in general,

have reported on the following sixteen

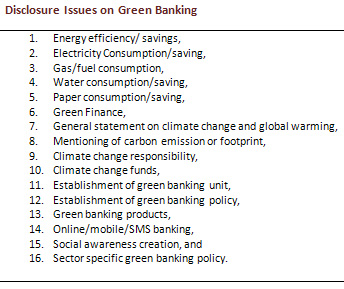

issues:

Table

3: Disclosure Issues on Green Banking

The findings of the research present

with the descriptive statistics that

notifies the number of banks that

presented these issues in the annual

reports over this three-year time

period.

After that, a qualitative discourse

analysis of green banking related

corporate narratives was conducted

in order to find out the nature of

language that was used. In discourse

analysis language is considered as

a social tool. Language is used for

a purpose. A discourse analyst, through

a close reading of the texts tries

to identify the motives and methods

of the text producers and also how

the readers interpret that produced

text (Baker and Ellece, 2011). This

analysis is mainly qualitative in

nature (Baker and Ellece, 2011). The

next section of the article presents

the findings of this research.

Findings and

Analysis

Among the ten banks selected for analysis,

one bank did not report on green banking

issues in any of these three years

(2011 to 2013) under consideration.

As at the beginning Bangladesh Bank

did not provide enough guidelines

on reporting on green banking; this

non-disclosure is not that surprising.

All the other nine banks reported

on green banking in each of these

three years under consideration. It

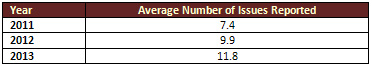

can be seen from Table 3 that on average,

in 2011, these ten banks reported

on around 7 issues (average is 7.4).

In 2012, this average goes up to 9

(average 9.9) and in 2013 it increases

again to 11 (average 11.8). So, it

can be said that on average, the level

of voluntary disclosure of green banking

issues increased over these three

years for these sample banks.

Table

4: Average Number of Issues Reported

in Each Year

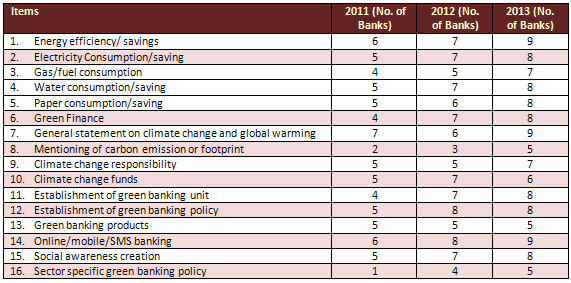

Table 5 gives an idea about the reporting

on each of the issues. It shows how

many banks have reported on each of

these issues in each year from 2011

to 2013. It can be seen that other

than the issue of "General statement

on climate change and global warming"

(No. 7), each of these issues were

reported by more banks in each consecutive

year. Although the issue of "General

statement on climate change and global

warming" had a drop in 2012,

it increased again in 2013. So, it

can be said that in each year, more

banks reported on each of these issues.

Table 5: No. of Banks Reporting each

of the Issues

Qualitative Discourse Analysis

This section of the article provides

some examples of the nature of language

that were used by the companies in

reporting on green banking. In terms

of presentation, materials were extracted

directly from the annual reports and

analyzed.

Definition of Green Banking

Some banks made an attempt to define

green banking, according to their

perception and idea. For example,

Rupali Bank Limited defined green

banking in the following manner:

(1) "Green banking is a simple

word but its magnitude is wider covering

social environment and economical

aspects. Green bank is a bank that

considers social and ecological factors

with an aim to protect environment

and conserve resources. Thus green

bankers concern about sustainable

development". [Annual Report

of Rupali Bank, 2013, p. 150]

The highlighted text in the quotation

was done by the authors. These highlighted

words demand attention. Firstly, it

can be seen that the issue of climate

change was not mentioned in this definition.

In the definitions given by the academicians

(mentioned in the introduction section

of this article), the issue of carbon

emission and climate change got huge

importance. Secondly, in this definition,

all the aspects of Triple Bottom Line

(TBL) - social, environmental and

economic - got ample importance. Thirdly,

they want to see green banking covering

both the social and the environmental

aspects (i.e., not the environmental

aspects alone). Fourthly, the issue

of sustainable development was highlighted

here (similar to Ahmed, Zayed and

Harun (2013)).

Another example can be presented here:

(2) "Green banking is to provide

innovative green products to support

the activities that are not harmful

to environment and to help to conserve

the environment. It aims to use the

resources of a bank with responsibility

avoiding spoilage and giving priority

to environment and society. Green

banking saves costs, minimizes the

risk, enhance bank's reputations and

contribute to the common good of environmental

sustainability. It serves both commercial

objectives of the bank as well as

its corporate social responsibility".

[Annual Report of Mercantile Bank

Limited, 2011, p. 148].

In this highly descriptive definition

both environment and society got importance.

In comparison to the other definitions

- (1) this definition is more focused

on economic aspects like 'saving cost',

'resources', 'bank's reputation' and

'commercial aspects'.

In summary, it can be said that the

definitions of green banking given

by these banks lack consistency. Though

the guidelines of Bangladesh Bank

mostly emphasize on the environmental

concerns, Banks have taken 'green

banking' as a social and economic

concern as well.

Energy Efficiency and Electricity,

Gas, Water and Paper Saving

Use of energy needs burning the fossil

fuel and as a result of this burning

carbon is emitted in the air. Burning

of fossil fuel contributes to global

warming in a negative manner. Banks

have emphasized on this issue in their

reporting.

In some cases, banks have used a general

statement on the efficient use of

energy and water. For example, Southeast

Bank Limited mentions:

(3) "Bank is concentrating

on its in-house green activities through

the most effective utilization of

resources (power, gas, fuel, water,

paper etc.)". [Annual Report

of Southeast Bank, 2013, p. 109].

Though this kind of statement highlights

the Bank's concern for energy and

water saving, a detailed picture is

not there. The use of the words like

'most effective utilization' may have

a positive impact on the minds of

the readers (stakeholders); this kind

of reporting lacks completeness. Readers

do not understand what kind of 'utilization'

was in process.

Some of the reports were more detailed.

The report of Islami Bank Bangladesh

Limited reported:

(4) "The bank advises the

officials to adopt energy efficient

practices. The officers try to ensure

efficient use of gas, fuel and electricity

with a view to reducing carbon emission.

Energy efficient equipments like energy

bulbs, less sound generators etc.

are used in the offices. The bank

also introduced the system of auto

shutdown of the electrical equipments."

[Annual Report of Islami Bank Bangladesh

Limited, 2013, p. 112]

In comparison to (3), this can be

considered as more detailed. The actions

taken (energy bulbs, less sound generator,

auto shutdown) for energy saving is

mentioned here. But again, this report

can be referred to as incomplete in

the sense that it did not mention

whether these actions really resulted

in energy saving or not. Again the

word 'advises' demands greater interpretation.

Advising does not mean that it is

mandatory to follow these practices.

The report of Eastern Bank Limited

contained the following information:

(5) "While others talk big

about energy conservation and using

alternative energy, we are humble

and action oriented. Four of EBL's

branches and six ATMs are powered

by solar energy. The bank has reduced

electricity and paper use consumption

by 33 percent and 40 percent respectively

in 2011 compared to 2010. Some 40

cars of the bank have also been converted

into CNG". [Annual Report

of Eastern Bank Limited, 2011, p.

107].

In comparison to (3) and (4), this

can be considered as having greater

detail. They mentioned the actions

taken by the bank and also the results

of these actions (reduction in consumption).

One interesting aspect of this report

(5) is that this bank wanted to compare

their level of sincerity with that

of the others in the market. It is

said here that others only go for

'big talk' and are not action oriented.

This statement indirectly gives an

indication that the reports of other

companies may be mere talk that lacks

authenticity.

It can be seen from the discussion

that the level/extent of reporting

varied from bank to bank. The reporting

lacks consistency because of the absence

of detailed guidelines from Bangladesh

Bank.

Green Finance and Sector Specific

Green Banking Policy

Green finance refers to financing

the projects that are environmentally

friendly. In the Annual Report of

Islami Bank Bangladesh Limited, a

definition of green finance was presented:

(6) "Green investment (finance)

implies the financial services to

the businesses and projects that help

prevent deterioration of the environment

as well as which are not harmful to

the environment". [Annual

Report of Islami Bank Bangladesh Limited,

2013, p. 109].

In case of green financing issue,

some banks have been very detailed

in reporting. For example, Islami

Bank Bangladesh Limited, in 2013,

has presented the total scenario through

a detailed table that contains information

about the 'number of projects/clients',

'disbursement during 2013' and 'outstanding'

amount. It can be seen from the table

that the bank divided the green finance

into two categories: direct green

investment and indirect green investment.

Under direct green investment they

mentioned about their financing in

projects like 'effluent treatment

plants', 'non-conventional and alternative

energy', 'environment friendly brick

kiln', 'clean water supply projects'

and 'recycling/reprocessing plants'.

But under the heading of 'indirect

green investment' they did not go

for such detail. Because of this lack

of detailing, 'indirect green investment'

remains a confusing term for the readers.

Whereas, Southeast Bank presented

their activities in a less detailed

manner:

(7) "Bank is one of the partners

of Bangladesh Bank's refinance facilities

for renewable energy generation and

other environmentally beneficial projects

like ETPs, energy efficient kilns

and brick fields. In the year 2013

Bank provided refinancing facility

to 7 Bio-Gas Projects and 137 Solar

Home Systems amounting to total BDT

4.30 million". [Annual Report

of Southeast Bank, 2013, p. 109]

Here, though the total amount of green

finance is mentioned, the exact amount

given to each project is not determinable.

Some banks have reported on their

specific policies related to financing

in some particular sectors.

For example:

(8) "Bank has inserted a mandatory

clause for installing ETP for any

Composite Textile, Dyeing units for

availing of investment from EXIM Bank.

Bank has disbursed Tk. 7.01 crore

for installation of ETP and Tk. 1405.46

crore in projects having ETP in the

year 2013". [Annual Report

of EXIM Bank, 2013, p. 39]

Again, the form and extent of reporting

on this issue varied from bank to

bank. The narratives ranged from a

general and short description of the

activities to detailed tables describing

each of the green finance projects.

Climate Change,

Carbon Emission and Climate Change

Fund

It was mentioned earlier that the

issue of climate change got immense

importance in the definitions of green

banking. Some banks showed their concerns

related to climate change and global

warming. Dutch-Bangla Bank Limited

mentioned:

(9) "The world has seen much

focus on economic progress and mankind

has made giant steps in its journey

through time. The side effects of

the development process have, however,

also been equally enormous - loss

of biodiversity, climatic change,

environmental damage, etc.".

[Annual Report of Dutch-Bangla Bank

Limited, 2012, p.173]

Though this kind of narrative does

not represent the activities of the

banks, it shows their concern about

the environment. The following statement

(10) can be considered as one where

the bank has linked the issue of climate

change with their activities:

(10) "Bank has approved Environmental

and Climate Change Risk as part of

existing Investment Risk Methodology

(IRG) to assess a prospective customer

and circulated sector wise check list

for complying at the time of preparation/processing

of relative investment proposal".

[Annual Report of EXIM Bank Limited,

2011, p. 31-32].

Assessing the prospective customers

and circulating sector wise checklist

represents two activities that were

performed in order to deal with the

climate change issues. Some banks

linked the issue of carbon emission

with the mitigating activities that

they adopt:

(11) "The bank has a good

number of products which are automated

and time savings for the customers.

Advanced technologies are being used

to provide prompt and environment

friendly customer services. The products

include i-banking, m-cash, online

banking, SMS banking, call center,

ATM services and phone banking which

help reduce carbon emission".

[Annual Report of Islami Bank Bangladesh

Limited, 2013, p. 110].

In some annual reports, the issue

of carbon emission was also linked

with green finance:

(12) "Financing low carbon

technology represents a unique opportunity

for banks to benefit from significant

growth of the low carbon technology

sector whilst demonstrating a positive

contribution in tackling climate change.

Many of the finance opportunities

of the future will be driven by the

investment demands of low carbon development.

In other words, capital is needed

to finance clean energy, less polluting

cars and buildings, next generation

public infrastructure, and many other

green assets". [Annual Report

of Dutch-Bangla Bank Limited, 2012,

p. 175].

It can be noticed from statements

(11) and (12) that banks tried to

link the issue of carbon emission

with the issue of technology. That

means, these banks believe that the

use of proper technology can be a

solution for reducing carbon footprints.

The issue of climate risk fund also

been highlighted in these reports.

In general, the banks that reported

on climate risk funds mentioned the

amount of money that is allocated

for this fund. For example, Rupali

Bank Limited mentioned:

(13) "RBL has allotted Tk.

4220 million in the bank's budget

of 2013 to perform green banking activities.

RBL has involved CSR activities covering

environmental, social, educational

and cultural advancement. However

the bank has participated by providing

Tk. 15.31 million in CSR activities

related to climate change fund".

[Annual Report of Rupali Bank, 2012,

p.113]

Though this statement (13) covers

the total amount of money allotted

as the climate risk fund, the activities

for which these funds were provided

or used were not mentioned clearly.

This can be found in the following

example (14):

(14) "IBBL has distributed

Taka 52.00 million (for flood Tk.

7.00 million and Disaster, Health

& Environment Tk. 45.00 million)

in the year 2012 (which was Tk. 48.05

million in 2011) among the climate

victims due to devastating flood,

chilling cold, severe drought etc.

in different parts of the country".[Annual

Report of Islami Bank Bangladesh Limited,

2012, p. 109].

Both examples - (13) and (14) - have

some features that are different.

Though both these statements disclose

the total amount of money spent as

a climate risk fund, example (14)

gives a clearer picture by giving

the breakdowns of the areas (flood,

disaster, health, and environment)

where these funds were utilized. Moreover,

example (14) also gives a comparative

picture of fund allocation in two

consecutive years - 2011 and 2012.

Example (13) declares the budget allocation

for the forthcoming year - 2013.

Even here it is to be noticed that

the disclosure pattern differed from

bank to bank as there was an absence

of proper format suggested by the

regulating body like Bangladesh Bank.

Online/SMS/Mobile Banking

Bangladesh Bank encouraged the online/mobile/SMS

banking mainly because of saving papers.

As paper production requires cutting

trees, it results in deforestation.

Deforestation results in global warming.

Some of the banks linked their reporting

on online banking with paper saving.

For instance:

(15) "To reduce paper use,

time, fuel consumption, MBL has introduced

online banking, SMS banking and Mobile

banking which are gaining popularity

day by day. These are allowing customers

to do banking transactions without

coming to the bank physically. Expansion

of ATM network is greatly reducing

the need for check book and reducing

consumption of security papers".

[Annual Report of Mercantile Bank

Limited, 2013, p. 147]

(16) "RBL is keen to emphasize

on the easiest way to save environment

by decreasing paper waste, reducing

carbon emission, reducing printing

costs and postal expenses".

[Annual Report of Rupali Bank Limited,

2012, p. 113]

Both of these statements highlight

the issue of paper saving. The first

statement (15) has a 'customer orientation'

in the sense that it is focusing on

the fact that because of online transaction,

customers can avail easily. The second

statement (16) has a 'strategic orientation'

as it highlights that online banking

is not only good for the environment

but it is also a cost saver. Expenses

related to paper, printing and mail

posts are decreased through online

banking. It needs to be mentioned

here that though these banks are claiming

that there is a decrease in paper

use, none of them mentioned how much

paper they have saved. The Bangladesh

Bank circular GBCSRD Circular Letter

No. 05 (issued in 2013) calls for

mentioning the amount of paper use

in the green banking reports.

Green Banking

Unit and Green Banking Policy

As a requirement of Phase- I of the

green banking program, Bangladesh

Bank asked the banks to adopt green

banking policy and establish a green

banking unit/cell. Banks reported

on this issue in their annual reports.

For instance Dutch Bangla Bank reports:

(17) "As directed by Bangladesh

Bank, an independent dedicated team

of Green Banking Cell has been working

consisting of 06 (six) officials from

related divisions led by Head of Credit

Division who may contribute with the

vested responsibilities in line with

the principles towards implementation

and reporting of green banking initiatives

of the bank". [Annual Report

of Dutch-Bangla Bank Limited, 2012,

p. 177].

(18) "A comprehensive Green

Banking Policy has formulated and

approved by the Board of Directors

in its 73rd meeting dated 19/06/2011.

A high powered Green Banking Committee

comprising the Directors of the Board

of the bank has also been formed to

determine/prepare banks environmental

policy, strategies and program. Bank

has also formed separate Green Banking

Unit of Cell comprising all the Head

of operational outlet assigning the

responsibilities of designing, evaluating

and administering related Green Banking

issues of the bank". [Annual

Report of EXIM Bank Limited, 2011,

p. 31]

It can be seen from the example that

the banks have reported on introducing

the green banking policy (18), the

composition of green banking cell

(17 & 18) and the tasks assigned

to the green banking cell (17 &

18).

Awareness

Creation - both inside and outside

the organization

Banks also reported on their activities

related to the creation of environmental

awareness. In terms of awareness creation

among employees, EXIM Bank reported:

(19) "A set of general instruction

already circulated to the employees

for efficient use of electricity,

water, paper and re-use of equipment"

[Annual Report of EXIM Bank Limited,

2011, p. 32].

This can be considered as an initiative

inside the organization. Banks also

reported on awareness creation outside

the organization. Southeast Bank,

in their report, emphasized on training

and introduction of Green Banking

awards:

(20) "Bank has also concentrated

on Green marketing, training and development.

The bank has decided to introduce

green awards to encourage individuals

and organizations who are actively

working to protect the environment

and tackle the risks of climate change

through green business, environment

friendly operations, community investment

and knowledge management".

[Annual Report of Southeast Bank Limited,

2013, p. 109].

Rupali Bank reported on their awareness

creation activities as follows:

(21) "RBL is using a slogan

"Plant tree, Save the environment"

in bank's letterhead and envelopes

in raising green awareness among its

shareholders and stakeholders…

Tree plantation project is encouraged

by the bank to raise awareness regarding

green banking". [Annual Report

of Rupali Bank Limited, 2011, p. 96].

Discussion

and Conclusion

The main objective of this research

was to investigate the nature of disclosure

of green banking in the annual reports

of Bangladeshi banking companies.

By analyzing the annual reports from

2011 to 2013 it was found that over

the years, the level of disclosure

increased. The form and extent of

disclosure differed from company to

company. On one hand, some of the

banks have only presented a general

statement that lacked specificity.

On the other hand, some of the banks

have provided detailed information

with specific quantitative information.

It can be seen even without a proper

guideline of reporting from the part

of Bangladesh Bank, companies took

initiatives to report on green banking

in their own way. It can be said that

as the banking sector is a relatively

more regulated and competitive sector

in Bangladeshi economy, they responded

to this call for reporting from Bangladesh

Bank. Though there were dissimilarities

in the pattern and language of disclosure,

most of these banks tried to disclose

the issues that were identified by

Bangladesh Bank as 'green banking

activities'. So, it can be said that

in this case, Bangladesh Bank was

considered as a powerful stakeholder

(as per the managerial branch of stakeholder

theory). This disclosure initiative

made them more efficient in the eyes

of this powerful stakeholder - Bangladesh

Bank (a powerful monitor of the Banking

sector of Bangladesh). So, it can

be expected that from 2014 onwards,

the reporting will become more uniform

as June 30, 2014 is the new deadline

for implementing the first phase of

the green banking program of Bangladesh

Bank and in GBCSRD Circular Letter

No. 05, they have provided a proper

format for green banking reports.

Moreover, some banks have taken green

banking as an impression management

tool. They have mentioned in the reports

their rankings in terms of their green

banking performance. One of the banks,

while defining green banking mentioned

that green banking helps in enhancing

corporate reputation (2). It can be

seen from the examples in the qualitative

discourse analysis section that these

banks mostly highlighted good news.

These mainly included their concern

for the environment and their positive

activities in order to conserve the

environment and prevent environmental

pollution. It can be said that these

banks in fact tried to gain legitimacy

from Bangladesh Bank and the society.

The level of environmental pollution

in Bangladesh is high. Moreover, it

is one of the countries that are getting

badly affected in terms of climate

change and global warming. The issue

of climate change is getting emphasized

by the government. Moreover, media

and environmental activists are also

highlighting the negative effects

of climate change. Climate change

and global warming have become common

buzzwords. In this situation, reporting

on environmental performance can help

the companies to manage impression

and gain legitimacy.

Though institutions (like GRI) that

are concerned with preparing guidelines

on sustainability reporting have produced

and disseminated the guidelines on

this kind of reporting before, many

prior researchers on corporate social

and environmental reporting on Bangladesh

found that the level/extent of this

kind of disclosure is low (was discussed

in details in the literature review).

It can be said that the declaration

of the guidelines from these international

agencies did not get much response

from the companies of Bangladesh.

But when a local authority (Bangladesh

Bank) proposed a green banking program,

the banks responded towards the proposed

activities as well as started reporting

on those activities even without having

proper reporting guidelines. From

this, it can be argued that local

authorities can act as better pressure

groups in comparison to the international

agencies. If the current status of

corporate social and environmental

reporting in Bangladesh needs to be

improved, a monitoring agency like

Securities and Exchange Commission

(SEC) should come up with a proper

and workable set of guidelines so

that the whole corporate sector becomes

serious about this issue.

References

Ahmad, F., Zayed, N. M. and Harun,

M. A. (2013). Factors behind the adoption

of green banking by Bangladeshi commercial

banks. ASA University Review, 7(2),

241-255.

Alam, M. (2006).Stakeholder Theory.

In Hoque, Z. (ed.). Methodological

issues in accounting research: Theories

and methods (pp. 207-222). London:

Spiramus.

Azim, M. I., Ahmed, S. and Islam,

M. S. (2009). Corporate social reporting

practice: evidence from listed companies

in Bangladesh. Journal of Asia-Pacific

Business, 10(2), 130-145.

Bahl, S. (2012a). The role of green

banking in sustainable development.

International Journal of Marketing,

Financial Services & Management

Research, 1(2), 27-35.

Bahl, S. (2012b). Green banking -

the new strategic imperative. Asian

Journal of Research in Business Economics

and Management, 2(2), 176-185.

Baker, P. and Ellece, S. (2011). Key

Terms in Discourse Analysis. London:

Continuum.

Bala, S.K. and Habib, A. (1998). Financial

Reporting to Employees: Bangladesh

Case. Dhaka University Journal of

Business Studies,19(1), June, 215-236.

Bala, S.K. and Yusuf, M.A. (2003).

Corporate Environmental Reporting

in Bangladesh: A Study of the Listed

Public Limited Companies. Dhaka University

Journal of Business Studies, XXVI(1),

June, 31-45.

Belal, A.R. (1999).Corporate Social

Reporting in Bangladesh. Social and

Environmental Accounting, 19(1), 8-12.

Belal, A.R. (2001), A Study of Corporate

Social Disclosures in Bangladesh,

Managerial Auditing Journal, 16/5,

pp. 274-289.

Belal, A. R. and Cooper, S. (2011).

The absence of corporate social responsibility

reporting in Bangladesh. Critical

Perspectives on Accounting, 22, 654-667.

Belal, A. R. and Owen, D. L. (2007).

The views of corporate managers on

the current state of, and future prospects

for, social reporting in Bangladesh:

an engagement based study. Accounting,

Auditing & Accountability Journal,

20(3), 472-494.

Berg, B. L. and Lune, H. (2012).Qualitative

Research Methods for the Social Sciences

(8th edition). Boston: Pearson.

Bhardwaj, B. R. and Malhotra, A. (2013).

Green banking strategies: sustainability

through corporate entrepreneurship.

Greener Journal of Business and Management

Studies, 3(4), 180-193.

Chowdhury, A.I. and Chowdhury, A.K.

(1996). Corporate Social Accounting:

Do We Need It? The Bangladesh Accountant,

April-June, 90-100.

Deegan, C. and Unerman, J. (2006).Financial

Accounting Theory (European edition).

London: The Mc-Graw-Hill Companies.

Freedman, M. and Jaggi, B. (2005).

Global warming, commitment to the

Kyoto protocol, and accounting disclosure

by the largest global public firms

from polluting industries. The International

Journal of Accounting, 40, 215-232.

Gray, R., Javad, M., Power, D. M.

and Sinclair, C. D. (2001). Social

and environmental disclosure and corporate

characteristics: a research note and

extension. Journal of Business, Finance

and Accounting, 28(3-4), 327-356.

Hossain, D. M (2014). The Development

of Social and Environmental Reporting

Research on Bangladeshi Organizations:

A Postcolonial Critique. Middle East

Journal of Business, 9(4), 9-20.

Hossain, D.M., Salat, A. and Amin,

A. (2005). Voluntary Disclosure on

Corporate Social Responsibility: A

Study on the Annual Reports of Bangladeshi

Companies. The Bangladesh Accountant,

47(20), 28-34.

Imam, S. (2000). Corporate Social

Performance reporting in Bangladesh.

Managerial Auditing Journal, 15(3),

133-141.

Islam, M. A. (2010). Social and environmental

accounting research: major contributions

and future directions for developing

countries. Journal of the Asia-Pacific

Center for Environmental Accountability,

16(2), 27-43.

Islam, M. A. and Deegan, C. (2008).

Motivations for an organisation within

a developing country to report social

responsibility information: evidence

from Bangladesh. Accounting, Auditing

& Accountability Journal, 21(6),

850-874.

Islam, M. A. and Islam, M. A. (2011).

Environmental incidents in a developing

country and corporate environmental

disclosures A study of a multinational

gas company. Society and Business

Review, 6(3), 229-248.

Islam, M. A. and Mathews, M. R. (2009).Grameen

Bank's social performance disclosure:

Responding to a negative assessment

by Wall Street Journal in late 2001.

Asian Review of Accounting, 17 (2),

149 - 162.

Khan, M. H., Halabi, A. K. and Samy,

M. (2009). Corporate social responsibility

reporting: a study of selected banking

companies in Bangladesh. Social Responsibility

Journal, 5(3), 344-357.

Khan, M. H. (2010).The effect of corporate

governance on corporate social responsibility

(CSR) reporting empirical evidence

from private commercial banks of Bangladesh.

International Journal of Law and Management,

52(2), 82-109.

Khan, A.R. and Hossain, D.M. (2003).Environmental

reporting as a corporate responsibility:

A study on the annual reports of the

manufacturing companies of Bangladesh.

The Bangladesh Accountant, January-March.

Khan, M. H., Islam, M. A., Fatima,

J. K. and Ahmed, K. (2011). Corporate

sustainability reporting of major

commercial banks in line with GRI:

Bangladeshi evidence. Social Responsibility

Journal, 7(3), 347-362.

Khan, A. R., Muttakin, M. B. and Siddiqui,

J. (2013).Corporate Governance and

Corporate Social Responsibility Disclosures:

Evidence from an Emerging Economy.

Journal of Business Ethics, 114, 207-

223.

Mathews, M. R. (1997). Twenty-five

years of social and environmental

accounting research Is There a silver

jubilee to celebrate? Accounting,

Auditing & Accountability Journal,

10(4), 481-531.

Meena, R. (2013). Green banking as

initiative for sustainable development.

Global Journal of Management and Business

Studies, 3(10), 1181-1186.

Muttakin, M. B. and Khan, A. (2014).

Determinants of corporate social disclosure:

empirical evidence from Bangladesh.

Advances in Accounting, incorporating

Advances in International Accounting,

http://dx.doi.org/10.1016/j.adiac.2014.03.005.

Ousama, A. A., Fatima, A. and Hafiz-Majdi,

A. R. (2012). Determinants of intellectual

capital reporting: evidence from annual

reports of Malaysian listed companies.

Journal of Accounting in Emerging

Economies, 2(2), 119-139.

Patten, D. (1991). Exposure, legitimacy

and social disclosure. Journal of

Accounting and Public Policy, 10,

297-308.

Prado-Lorenzo, J., Rodriguez-Dominguez,

L., Gallego-Alvarez, I. and Garcia-Sanchez,

I. (2009).Factors influencing the

disclosure of greenhouse gas emissions

in companies world-wide. Management

Decision, 47(7), 1133-1157.

Rashid, A. and Lodh, S. C. (2008).The

influence of ownership structures

and board practices on corporate social

disclosures in Bangladesh. Research

in Accounting in Emerging Economies,

8, 211-237.

Roberts, R. (1992). Determinants of

corporate social responsibility disclosure:

an application of stakeholder theory.

Accounting, Organisations and Society,

17(6), 595-612.

Sobhani, F. A., Amran, A. and Zainuddin,

Y. (2012). Sustainability disclosure

in annual reports and websites: a

study of the banking industry in Bangladesh.

Journal of Cleaner Production, 23,

75-85.

Spicer, B. (1978). Investors, corporate

social performance and information

disclosure: an empirical study. The

Accounting Review, 53, 94-111.

|