|

Customer progression and perception

about premium men's apparel brands:

A case of Indian male professionals

Supriti Agarwal (1)

Sonia Singh (2)

(1) Assistant Professor,

Amity University, Noida, India

(2) Assistant Professor

Al Dar University College

Dubai, United Arab Emirates

Correspondence:

Dr Supriti Agarwal

Assistant Professor,

Amity University, Noida, India

Email: sagrawal2@amity.edu

Abstract

A

major challenge before companies today

is to understand the hybrid behavior

of the customer. On one side customers

are becoming price sensitive for bargains

and on the other they want to enjoy

world class brands and luxury goods.

Literature also shows that in recent

time there is a considerably huge

economic rise of disposable income

within the middle class which is leading

to consumption of branded products

in masses. Today luxury brand have

changed to affordable luxury brand

and will change to premium brands

in the near future. This study explores

the variables influencing consumer

progression and perception towards

premium brands. This study also explores

the relationship between demographics

and the brand preference. To accomplish

this task a questionnaire was prepared

and a total of 190 respondents who

have earned a professional degree

like engineering or management or

some higher educations like Ph.D were

interviewed. We have considered those

respondents who are employed in private

or government sectors only. It was

found that most consumers associated

greater accessibility of premium brands

in the Indian market with better quality,

though at higher price as they evaluate

them higher on quality, status and

esteem. This paper tries to segment

the market on the basis of different

clusters and also tries to find factors

affecting the perception of customers

for the buying of apparel.

Key

words: Customer perception, men's

apparel brands, Indian professionals

1. Introduction

With every passing year, intensity

of competition is becoming fiercer

due to globalization. Competition

is rising not only in differentiating

one product and service from another

but also in logistics, access to information

and so on. Now-a-days customers are

becoming more hybrid as they are not

only better informed but also they

have wider choices of less distinguishable

products due to easy access to internet

and online shopping trend. Across

the world customers are aware of their

increasing power due to which there

is a sharp increase in customers'

expectations from the companies in

terms of their basket of offerings

has been noticed. After New Economy

Policy 1991, the Indian economy noticed

a remarkable increase in the investment

by MNC's which in turn increases the

living standard of Indians, especially

the middle class who have the highest

marginal propensity to consume. Due

to all this in India high end luxury,

high value services, high information

access and high technology are increasing.

India is moving fast in each spectrum

be it retail, services, real estate,

hospitality on the consumer front

or value added B2B services or even

our capabilities in out sourcing at

company front. All these have given

a sharp increase in both income and

mindset of the middle class income

group, for them luxury is now a life

style not only a fashion statement.

Luxury items may be automobiles to

clothing, accessories, perfumes, all

are beating sales target in India.

2. Research

Purpose

Now in India with the advent of MNC's

and subsequent rise in white collar

jobs, the apparel industry, especially

in the men's segment, is increasing.

The young generation, especially in

management positions, are cognitively

orienting towards brands and trying

to find psychological identity by

grooming personality and self concept.

So in this paper we try to find the

factors affecting perception for buying

the premium brands and we also try

to segment the market for branded

apparels.

3. Literature

Review

Alden, D.I., Steenkamp, J.B. and Batra,

R., (1999), proposed, operationalized

and tested a new construct, GCCP-Global

Consumer Culture Position. This construct

associates the brand with a widely

understood and recognized set of symbols

believed to constitute emerging global

consumer culture. Holt, D.B., Quelech,

J.A., and Taylor, E.L. (2004) argued

that global branding should not be

interpreted as a call to rid traditional

brands of their national brands of

their national heritage, the two reasons.

Firstly, while globalness has become

a stronger quality signal than nation

of origin, consumers still prefer

brands that hail from countries that

are considered to have particular

expertise : Switzerland in chocolates,

Italy for clothing, France in cosmetic,

Germany in cars, Japan in electronics,

for example. More important, consumers

expect global brands to tell their

myths from the particular places that

are associated with the brand. For

Nestle to spin a credible myth about

food, the myth must be set in the

Swiss mountains, because that is where

people imagine the brand hails from.

As per Holt, D.B.(1995) there are

four types of consuming as experience

-- subjective, emotional reactions

to consumption objects, consuming

as integration -- consumer's acquire

and manipulate object meanings, consuming

as classification -- consumed objects

are used to classify consumers, consuming

as play -- how consumption objects

are used to play.

It is impossible to predict the culture

profile from the income position and

vice versa. There is an influence

of income and culture over the consumption

of luxury products. Income induces

consumers to acquire luxury goods.

The penetration of luxury goods is

at a maximum between the "wealth

on trend" (Doubois B and Duquesne,

P (1993). (Cesare Amatulli, Gianluigi

Guido, 2010) Consumers buy luxury

fashion goods mainly to match their

lifestyle, thus satisfying their inner

drives. The hierarchical value map

resulting from the data collection

and elaboration demonstrates that

self?confidence and self?fulfillment

are the main hidden final values when

buying and consuming luxury goods.

Implications for marketers are related

to tailoring products, brand values

and communication messages to the

subjective, self?rewarding and "internalized"

consumption sought after by consumers.

In their analysis Eng Tech-Young,

Bogaert Julie (2010) suggest that

luxury consumption conveys certain

identity through matching symbolic

meaning of luxury and consumption.

This identity is concerned with personal

values of wealth, status and socio

economic success derived from luxury

consumption. In this regard consumers'

perceptions of luxury are susceptible

to the reference group. In turn, reference

groups influence predilection for

luxury as part of extended self, but

with perceived uniqueness from combining

traditional Indian styles with the

possession of western luxury products.

In their result results Zhongqi Jin

and Bal Chansarkar, N.M. Kondap, (2006)

demonstrated that most consumers can

recognize the brand origin correctly

but the power of recognition decreases

when the brand has a long history

of "localization". Distinguished

trajectories of consumer perceptions'

of foreign brands and domestic brands

were projected, and this allowed one

to extend existing country of origin

(CO) research to brand of origin research.

In their research Mandel, N., Pertrova,

P.K. and Craldini, R.B.(2006) provides

a necessary examination of how consumers'

purchasing habits are influenced by

comparisons with individuals who are

wealthier and more successful than

themselves. The consumption of luxury

goods involves purchasing a product

that represents value to both the

individual and their reference group.

Referring to personal and interpersonal

oriented perceptions of luxury, it

is expected that different sets of

consumers would have different perceptions

of the luxury value for the same brands,

and that the overall luxury value

of a brand would integrate these perceptions

from different perspectives. Even

if the overall luxury value level

of a certain product or brand may

be perceived equally across national

borders, a differentiated measurement

may reveal that the overall luxury

value perception is a combination

of different evaluations with regard

to the sub-dimensions. Furthermore,

this differentiated perception of

luxury value may be dependent on the

cultural context and the people concerned

(Wiedmann, K.P., Hennigs N, Siebils

A, 2007).

4. Research

Methodology

Objectives:

The main objectives of the study are:

1. To evaluate the customer's

perception towards the purchase of

premium segment apparels.

2. To know whether the demographic

variables of respondent have influence

on selecting a premium brand.

3. To know the important variables

that influences the respondents in

purchasing a premium apparel brands.

Types of Research Methods Used

Phase 1: Premium segments are

relatively new in India. Luxury brand

from a recent past are considered

as premium brands today. There is

little empirical evidence to help

marketers fully understand what constitute

progression and perception towards

these brands. Therefore, the imperative

of the exploratory study is to gain

much needed background of information

pertaining to customer perception

towards premium apparel brands. This

exploratory study helped us in descriptive

research by developing the scales

for the survey instruments.

Phase 2: The purpose of the

descriptive research is to evaluate

the customer perception towards premium

brands, to know the important variable

that influences the respondent in

purchasing a premium apparel brand

and influence of demographic behavior.

For this we have used the followings:

• Factor Analysis

• Cluster Analysis

These are used to analyse and evaluate

customer progression and perception

towards premium brands.

Sampling:

As our research is mainly for the

men's section, they are also those

at management level positions and

those who have earned some higher

degree and are coming into high income

brackets, we have used convenient

sampling. While doing the pilot study

we came across one problem in our

demographic segment of questionnaire.

We asked the respondents about their

qualifications and we gave them options

like engineering, management study

or some higher study like PhD. In

our pilot study of 10 respondents

there was one respondent who had done

his engineering after that MBA and

also PhD. So to avoid confusing we

have considered only the higher education

of the respondents. So in the initial

stage of conducting the research we

took the sample size of 300 respondents

in order to collect relevant data

and all participants were made aware

of research intention and design by

an introduction. As time was limited

for the study, out of 300 distributed

we got 192 fully filled questionnaires

and out of 192 for the convenience

of research we discarded 2 questionnaires.

So this study was done with 190 respondents.

5. Discussion

on results

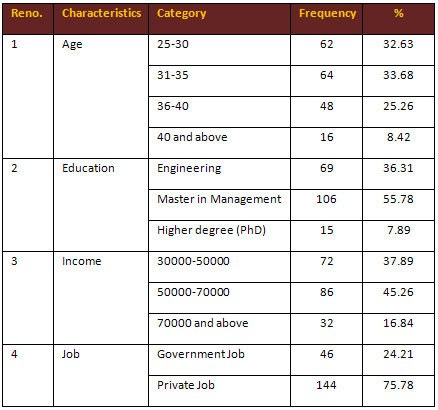

Demographic segmentation of respondents:

As our survey was related to men's

apparel all our respondents were men

only, but we had to be very careful

in choosing the sample. Almost 66%

of respondents are from age group

25 to 35 and the rest, 34 % are 35

years and above. Out of 190 respondents

almost 56% of respondents have done

a Masters in management, and then

almost 36% of respondents' highest

qualification was engineering. In

the income group almost 45% of respondents

were in income group 50000-70000 INR

and almost 38% for income group 30000-

50000 INR and 17% were above 70000

INR. Almost 76% of respondents were

in private jobs and the rest in government

jobs.

Table 1: Demographic Characteristics

of Respondents

Factor Analysis to identify important

factors:

Factor analysis attends to identify

underlying variables or factors that

explain the pattern of correlation

within a set of observed variables.

Factor analysis is often used in data

reduction, by identifying a smaller

number of factors which explains most

of the variant observed in a much

larger number of variables.

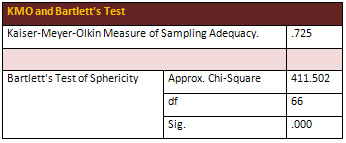

Sample Adequacy

A set of fourteen variables are considered

to be important to know the customer

shopping behavior for premium apparel

brands. These were subjected to principal

component analysis, using varimax

rotation with Kaiser Normalization

in order to reduce the multiplicity

of variable into selected factor.

First of all, let us observe the values

of Bartlett's Test of sphericity and

Kaiser-Meyor-Olkin(KMO) measure of

sampling adequacy.

Table 2: KMO and Bartlett's Test

As depicted in Table 2 the KMO measure

of sampling adequacy for this sample

was 0.725, which is greater than 0.5

and suggests that data is adequate

for factor analysis.

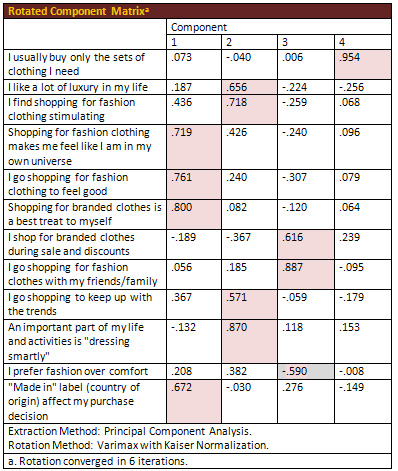

Interpretation of factors:

After this, factor analysis using

Varimax rotation and Kaiser Normalization

was conducted. As a result, four factors

were obtained. A rotated component

matrix along with factor is given

in the table below:

Table 3: Rotated Component Matrix

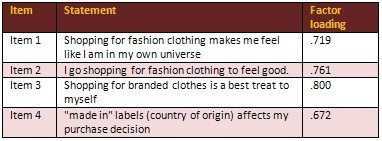

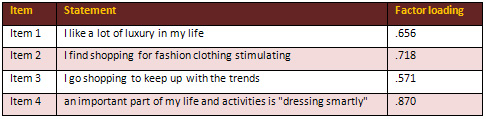

Factor C1: Shopping Stimulus

As shown in Table 4, all loadings

of item in factor C1 are significantly

high. Four variables with positive

loading are extracted in factor C

1. The positive loading indicates

that these four variables share most

of their variances between them and

thereby co-vary with each other. This

factor exhibits that the customer

finds shopping very stimulating, which

gives them a very happy feeling and

is a treat to them. In addition to

this, respondents prefer fashion over

comfort and dressing smartly is an

important activity in their life.

Table 4: Factor loadings of Factor

1

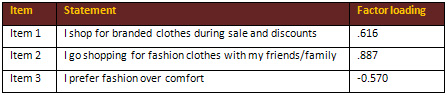

Factor C2: Brand Pullers

As depicted in Table 5, high positive

loading has been observed on some

variables. This variable shows that

customers give importance to their

self-actualization and Self-esteem

needs.

Table 5: Factor loadings of Factor

2

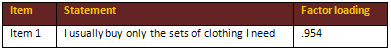

Factor C3: Shopping Delight

As depicted in Table 6, high positive

loading have been observed on the

variable - Buying branded clothes

give me a lot of pleasure. This variable

shows that customers give importance

to brands they buy which in return

give them pleasure

Table 6: Factor loadings of Factor

3

Factor C4: Self satisfied buyers

As depicted in Table 7, high positive

loading have been observed on the

variable- They enjoy the clothes what

they have and are very satisfied with

what they possess. This variable shows

that respondents hesitate to spend

money on premium brands.

Table 7: Factor loadings of Factor

4

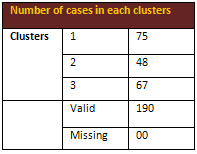

Cluster Analysis for market segmentation:

Factor analysis, multidimensional

scaling and cluster analysis all are

interdependence techniques and no

distinction between dependent and

independent variables is made. Both

factor analysis and cluster analysis

are data reduction techniques but

the major difference is that factor

analysis is done by grouping variables

where as cluster analysis is by reducing

observations in a smaller number of

observations. So in order to identify

the market segment for different apparel

brands by grouping them in same cluster

we have performed cluster analysis

by using (K means) in Table 8.

Table 8: Cluster Analysis (K Means)

Interpretation of Cluster1: Premium

Brands Diehards

On the basis of the opinion of the

population towards the premium brands,

people belonging to this group are

highly influence by premium brands.

They consider premium brands as durable

and high quality. They strongly believe

that premium brands reflect their

personality and they do not mind paying

a high price for them. They enjoy

spending times in these stores as

it offers them a good shopping environment.

They believe that premium brands help

them gain face.

Profile: Premium brands diehards

are the customers with positive notions

about a brand, and are loyal customers

of these segments of apparels.

Interpretation of Cluster 2: Non

Fascinated Customer

On the basis of the opinion of the

population towards premium brands,

people belonging to this group agree

with the fact that premium brands

demonstrate success and social status.

But this set of population believes

premium brands do not help to gain

face and are unbiased on the quality

and durability of the products. They

strongly believe that premium brands

apparel is highly priced.

Profile: As the name suggests

non fascinated customer are unenthusiastic

about premium brands and do not show

a very high interest in purchasing

them.

Interpretation of Cluster 3: Consumer

on the Fence

On the basis of the preference and

the choice of premium brands, the

population of this set is in agreement

that premium brands are durable and

are of high quality. They do not strongly

agree that premium brands reflect

one's personality and social status

but are giving consent to the statement.

More emphasis should be given to this

set of consumers as they are highly

switchable and constitute the major

chunk of the same population.

Profile: Consumers on the fence are

highly switchable and can be turned

to loyal customers if taken care off.

6. Finding and

Conclusions

Indian consumer demonstrate unique

purchasing behavior due to the diversity

of the population, as we find all

age groups, income groups and educational

qualification people are using home

made products to most branded products.

It is very important to understand

the perception in such a vast and

growing market where the male population

is also becoming more brand conscious

and are constantly looking out for

global premium brand as they give

them a status, confidence and pleasure

of shopping. Research shows consumers

between the ages of 20-35 years have

been the prime market for premium

brands.

If we conclude the answer of the respondent,

we can say that they perceived premium

brands as quality products. This perception

can often serve as a rationale for

premium brands to charge high prices.

Consumers also believe that these

transnational companies compete by

trying to develop new products and

are very dynamic, always upgrading

themselves with respect to the fashion

and global trend.

References

1. Alden, D.I., Steenkamp,

J.B. and Batra, R., (1999),"

Brand positioning through advertising

in Asia, North America, and Europe:

The role of global consumer culture

", Journal of Marketing, Vol.63,

pp.75-87.

2. Atwal G. and Williame A.

"Luxury Brand Marketing - The

experience is everything!" Journal

of Brand Management ,Volume 16,pp-338-346

3. Cesare Amatulli, Gianluigi

Guido,(2010) "Determinant of

Purchasing Intentions for Fashion

Luxury Goods in Italian Market",

Journal of Fashion Marketing and Management,

Vol.15, Issue 1, pp.123-136.

4. Doubois B and Duquesne,

P (1993), " The market for luxury

goods: income vs culture", European

Journal of marketing, Vol.21,No. 1,pp.35-44.

5. Eng, Teck-Yong, Bogaert,

Julie," Psychological and cultural

insights into consumption of luxury

Western brand in India", Journal

of customer behavior, Vol.9, No.1

Spring 2010, pp.55-75)

6. Holt, D.B. (1995) "

How consumers consume : A typology

of consumption practices", Journal

of Consumer Research , Vol.22,No.6,

pp 1-16.

7. Holt, D.B., Quelech, J.A.,

and Taylor, E.L. (2004), "How

global brands compete ", Harvard

Business Review , Vol. 82 ,No.9, pp.68-75

8. Mandel, N., Petrova, P.K.

and Cialdini, R.B.(2006) , "

Images of success and the preference

for luxury brands", Journal of

Consumer Psychology ,Vol.16,No.1,pp.56-69

9. S. Ravichandran "Daily

News. Ik, Wednesday, 1st July 1999.

10. Wiedmann, K.P., Hennigs

N, Siebils A,(2007) "Measuring

Consumers' Luxury Value Perception:

A Cross-Cultural Framework" ,Academy

of Marketing Science , Vol,11,pp-1-21.

11. Zhongqi Jin and Bal Chansarkar,

N.M. Kondap, (2006) "Brand Origin

is an Emerging Market: Perception

of Indian Consumer", Asia Pacific

Journal of Marketing and Logistics,

Vol.18 Iss: 4, pp.283-302.

|