|

Impact of Value Creation on Stock

Prices: A Study of Amazon.Com, Inc

Esha

Jain (1)

Manish Madan

(2)

Sonia Singh (3)

(1) Dr.

Esha Jain, School of Management,

G. D. Goenka University, Gurgaon

(2) Prof. (Dr.) Manish Madan,

Rukmini Devi Institute of Advanced

Studies, Rohini, Delhi

(3) Dr. Sonia Singh, School of Business

(Adjunct Faculty)

Al Falah University, Dubai

Correspondence:

Dr.

Sonia Singh, School of Business (Adjunct

Faculty)

Al Falah University, Dubai

Email: sonia23singh@gmail.com

Abstract

The handwriting has been on the

wall for a long time, but a lacklustre

economy and ongoing financial turmoil

have underscored the broad trend that

has fundamentally altered how private

equity investors make money. Private

equity firms can no longer rely solely

on the power of leverage and ever-expanding

price-earnings multiples to generate

superior returns. More private equity

firms wielding more capital have bid

up acquisition prices, putting pressure

on potential investment gains. In

this study, one of the most common

indicators, Relative Strength Index

(RSI) was used to analyse the market

movements of Amazon.com, Inc. over

a period of the last 290 days. As

the study describes the existing price

movements of the selected company,

the research design followed was descriptive

and analytical research design. The

company was chosen completely on the

basis of convenient sampling technique

which is non-probability in nature.

This study is significant for investors

and traders as it leads to identify

the level of price movement that further

helps in understanding buying and

selling situations in the market by

identifying support and resistance

levels.

Key words: Market movements,

relative strength index, stock exchange,

value creation.

1. Introduction

Value creation is performance of actions

that increase the worth of goods,

services or even a business. Many

business operators now focus on value

creation both in the context of creating

better value for customers purchasing

its products and services, as well

as for shareholders in the business

who want to see their stake appreciate

in value. Value creation is a corporation's

raison d'être, the ultimate

measure by which it is judged. In

the 1990s, the main emphasis of executives

was on creating value for shareholders-a

value that was reflected in movements

of the company's stock price. But

measures based on stock market values

are subject to the same wild fluctuations

as the market itself. In a rising

tide, all boats get raised. But when

macroeconomic changes force up markets

generally, it does not mean that the

value of each individual company in

that market has changed similarly.

Markets are moved by sentiment that

has little to do with the underlying

value of individual corporations.(1)

Amazon strives to be Earth's most

customer-centric company where people

can find and discover virtually anything

they want to buy online. By giving

customers more of what they want -

low prices, vast selection, and convenience

- Amazon continues to grow and evolve

as a world-class e-commerce platform.

It is the largest Internet-based retailer

in the United States.(2)

Founded by Jeff Bezos, the Amazon.com

website started in 1995 as a place

to buy books because of the unique

customer experience the Web could

offer book lovers. Bezos believed

that only the Internet could offer

customers the convenience of browsing

a selection of millions of book titles

in a single sitting. During the first

30 days of business, Amazon fulfilled

orders for customers in 50 states

and 45 countries - all shipped from

his Seattle-area garage.(3)

Amazon's evolution from Web site to

e-commerce partner to development

platform is driven by the spirit of

innovation that is part of the company's

DNA. The world's brightest technology

minds come to Amazon.com to research

and develop technology that improves

the lives of shoppers and sellers

around the world. In 2015, Amazon

surpassed Walmart as the most valuable

retailer in the United States by market

capitalization. (4)

Amazon's stock is listed on NasdaqGS.

The NASDAQ Stock Market, commonly

known as the NASDAQ, is an American

stock exchange. It is the second-largest

exchange in the world by market capitalization,

behind only the New York Stock Exchange.

On July 1, 2006, the NASDAQ National

Market was renamed the NASDAQ Global

Market. In conjunction with this,

NASDAQ created the new NASDAQ Global

Select Market, a segment of the NASDAQ

Global Market with the highest initial

listing standards of any exchange

in the world. (5)

Footnotes

1. http://www.economist.com/node/14301714

2. Jopson, Barney (July 12, 2011).

"Amazon urges California referendum

on online tax". Financial Times.

3. https://www.linkedin.com/company/amazon

4. http://www.nytimes.com/2015/08/16/technology/inside-amazon-wrestling-big-ideas-in-a-bruising-workplace.html?_r=0

5. http://www.nasdaq.com/about/Top_Tier_Splash.stm

2. Review of

Literature

Errunza, V. R., & Losq, E.

(1985) investigated the behaviour

of stock prices for a group of well-established

and newly emerging LDC securities

markets and the derived results suggested

that the probability distributions

to be consistent with a lognormal

distribution with some securities

exhibiting non-stationary variance.

LDC markets, even though not as efficient

as major DC markets, are quite comparable

to the smaller European markets and

the behaviour of security prices as

reported in their study appears to

be generalizable for the heavily traded

segments of LDC markets.

Jegadeesh, N., & Titman, S.

(1993) documented that strategies

which buy stocks that have performed

well in the past and sell stocks that

have performed poorly in the past

generate significant positive returns

over a 3 to 12 months holding period.

They found that the profitability

of those strategies (Returns of Relative

Strength Portfolios) were not due

to their systematic risk or to delayed

stock price reactions to common factors.

The returns of the zero-cost winners

minus losers' portfolio were examined

in each of the 36 months following

the portfolio formation date. With

the exception of the first month,

the portfolio realized positive returns

in each of the 12 months after the

formation date. However, the longer

term performances of these past winners

and losers revealed that half of their

excess returns in the year following

the portfolio formation date dispatch

within the following two years.

Pruitt, S. W., & White, R.

E. (1988) attempted to directly

determine the profitability performance

of a multi-component technical trading

system incorporating price, volume,

and relative strength indicators on

individual security issues. The system

they tested, to which they had given

the acronym CRISMA to represent its

component parts (Cumulative Volume,

Relative Strength, Moving Average),

is completely ex-ante in nature and

outperformed the market over a significant

interval of time, even after adjusting

for problems of trade timing and risk,

and after allowing for round-trip

transaction costs up to 2% per security

trade.

Tsaih, R., Hsu, Y., & Lai,

C. C. (1998) presented a hybrid

AI (artificial intelligence) approach

to the implementation of trading strategies

in the S&P 500 stock index futures

market. The hybrid AI approach integrates

the rule-based systems technique and

the neural networks technique to accurately

predict the direction of daily price

changes in S&P 500 stock index

futures. Based upon this hybrid AI

approach, the integrated futures trading

system (IFTS) was established and

employed to trade the S&P 500

stock index futures contracts. Empirical

results also confirmed that IFTS outperformed

the passive buy-and-hold investment

strategy during the 6-year testing

period from 1988 to 1993.

Amit, R., & Zott, C. (2000)

explored the theoretical foundations

of value creation in e-business by

examining how 59 American and European

e-businesses became publicly traded

corporations create value and observed

that in e-business, new value can

be created by the ways in which transactions

are enabled. Developed a model based

on study, they suggested that the

value creation potential of e-businesses

hinges on four interdependent dimensions,

namely: efficiency, complementarities,

lock-in, and novelty. They also found

that no single entrepreneurship or

strategic management theory can fully

explain the value creation potential

of e-business.

Gunasekarage, A., & Power,

D. M. (2001) analysed the performance

of one group of these trading rules

using index data for four emerging

South Asian capital markets (the Bombay

Stock Exchange, the Colombo Stock

Exchange, the Dhaka Stock Exchange

and the Karachi Stock Exchange) and

examined the implications of the results

for the weak form of the efficient

market hypothesis. The findings indicated

that technical trading rules have

predictive ability in these markets

and rejected the null hypothesis that

the returns to be earned from studying

moving average values are equal to

those achieved from a naive buy and

hold strategy.

Hameed, A., & Kusnadi, Y. (2002)

analysed that the momentum returns

of more than 1 percent per month is

observed when applied to less diversified

portfolios consisting of firms with

small market capitalization or high

volume of trade, suggesting that price

momentum is related to firm specific

factors.

Wong, W. K., Manzur, M., &

Chew, B. K. (2003) focused on

the role of technical analysis in

signalling the timing of stock market

entry and exit. Test statistics were

introduced to test the performance

of the most established of the trend

followers, the Moving Average, and

the most frequently used counter-trend

indicator, the Relative Strength Index.

Using Singapore data, the results

indicated that the indicators can

be used to generate significantly

positive return. It was also found

that member firms of Singapore Stock

Exchange (SES) tend to enjoy substantial

profits by applying technical indicators

and concluded it as the main reason

why most member firms do have their

own trading teams that rely heavily

on technical analysis.

Wang, C. (2004) examined among

national stock prices of four Asian

Newly Industrializing Countries stock

markets - Taiwan, South Korea, Singapore

and Hong Kong - in models incorporating

the established markets of Japan,

USA, UK and Germany. The results consistently

appear to suggest the relatively leading

role of all established markets in

driving fluctuations in the NIC stock

markets. In other words, all established

markets and Hong Kong, consistently

were the initial receptors of exogenous

shocks to the (long-term) equilibrium

relationships and the other NIC markets,

particularly the Singaporean and Taiwanese

markets had to bear most of the burden

of short-run adjustment to re-establish

the long-term equilibrium relationship.

In comparison to all other NIC markets,

Taiwan and Singapore appear as the

most endogenous, with Taiwan providing

evidence of its short-term vulnerability

to shocks from the established markets.

Pan, R. K., & Sinha, S. (2007)

analysed the cross-correlation

matrix C of stock price fluctuations

in the National Stock Exchange (NSE)

of India to investigate the universality

of the structure of interactions in

different markets and found that this

emerging market exhibits strong correlations

in the movement of stock prices compared

to developed markets, such as the

New York Stock Exchange (NYSE). This

showed the dominant influence of a

common market mode on the stock prices.

By comparison, interactions between

related stocks, were found to be much

weaker. This lack of distinct sector

identity in emerging markets was explicitly

shown by reconstructing the network

of mutually interacting stocks. Spectral

analysis of C for NSE revealed that

the few largest eigenvalues deviate

from the bulk of the spectrum predicted

by random matrix theory, but they

were far fewer in number compared

to, e.g., NYSE. They showed this due

to the relative weakness of intra-sector

interactions between stocks, compared

to the market mode, by modelling stock

price dynamics with a two-factor model.

They also suggested that the emergence

of an internal structure comprising

multiple groups of strongly coupled

components is a signature of market

development.

3.

Objectives of the Study

The main objective of the study is

to do relative strength analysis,

with the help of RSI indicator, of

a particular scrip to interpret buying

and selling conditions in the market.

Also the objective of the study is

to analyse price movements over a

period of last 290 days.

4. Research

Methodology

The study aims at analysing the price

movements of Amazon.com, Inc. over

a period of last 290 days and as the

study describes the existing price

movements of the selected company,

the research design followed was descriptive

and analytical research design. The

company was chosen completely on the

basis of convenient sampling technique

which is non-probability in nature.

This study is significant for investors

and traders as it leads to identify

the level of price movement that further

helps in understanding buying and

selling situations in the market by

identifying support and resistance

levels. To achieve the desired objective,

the daily share price movements of

the selected company was absorbed

for 290 days, i.e. from 1st April

2015 to 15th January 2016. As the

company is listed on NasdaqGS (NASDAQ

Global Select Market) so the data

was collected from the website of

Nasdaq and Bloomsberg. After that,

the closing prices of share prices

were taken and the future price movement

was analysed using Relative Strength

Index Indicator of technical analysis.

Data was collected as available on

Nasdaq and Bloomsberg website as on

16th January 2016-evening.

5. Data Analysis

and Interpretations

The data was analysed by using Relative

Strength Analysis, the most common

and reliable indicator of technical

analysis of stock markets. Relative

Strength Index (RSI) is a popular

momentum oscillator developed by J.

Welles Wilder Jr. It is not to be

confused with relative strength, which

compares a stock's price performance

to that of an overall market average,

such as the S&P 500. Instead,

the RSI analyses the recent performance

of a security in relation to its own

price history. RSI is a valuable tool

to determine overbought/oversold levels.

The Relative Strength Index compares

upward movements in closing price

to downward movements over a selected

period. Wilder originally used a 14

day period, but 7 and 9 days are commonly

used to trade the short cycle and

21 or 25 days for the intermediate

cycle. The RSI value will always move

between 0 and 100; the value will

be 0 if the stock falls on all 14

days, and 100, if the price moves

up on all the days. This implies that

the RSI can also be used to identify

the overbought/oversold levels in

a counter. As suggested by J Welles

Wilder, the developer of this indicator,

most technical analysts consider the

RSI value above 70 as 'overbought

zone' and below 30 as 'oversold zone'.

However, investors and traders need

to adjust these levels according to

the inherent volatility of the scrip.

It is computed on the basis of the

speed and direction of a stock's price

movement. This means that the RSI

indicator only measures the stock's

internal strength (based on its past)

and should not be confused with its

relative strength, that is compared

with other stocks, market indices,

sectoral indices, etc.

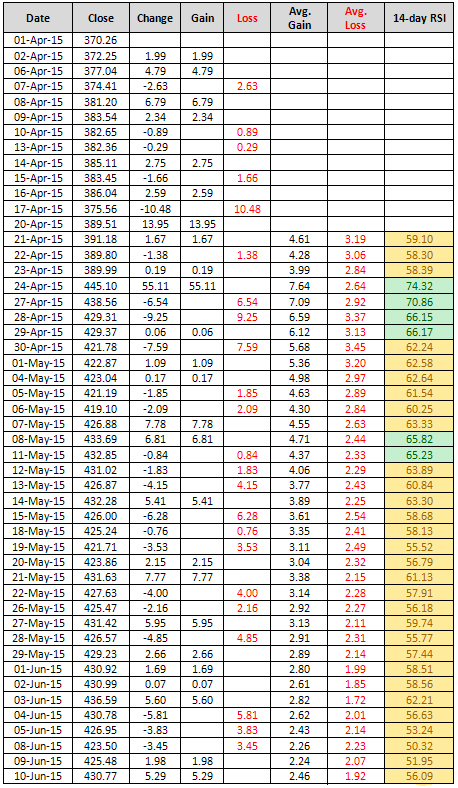

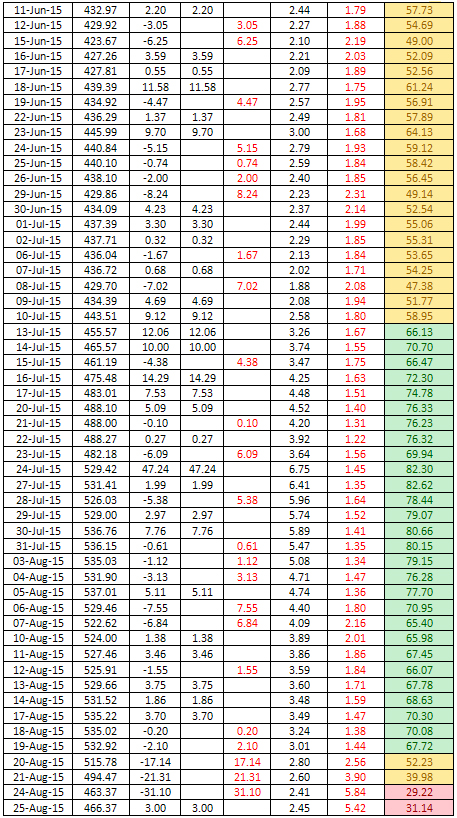

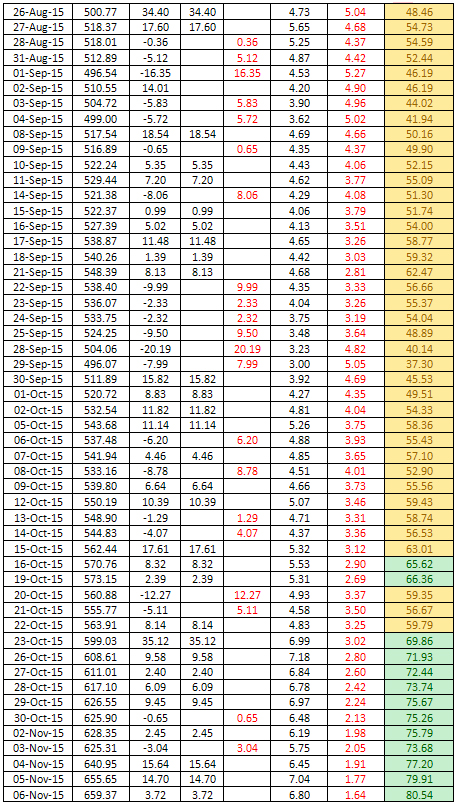

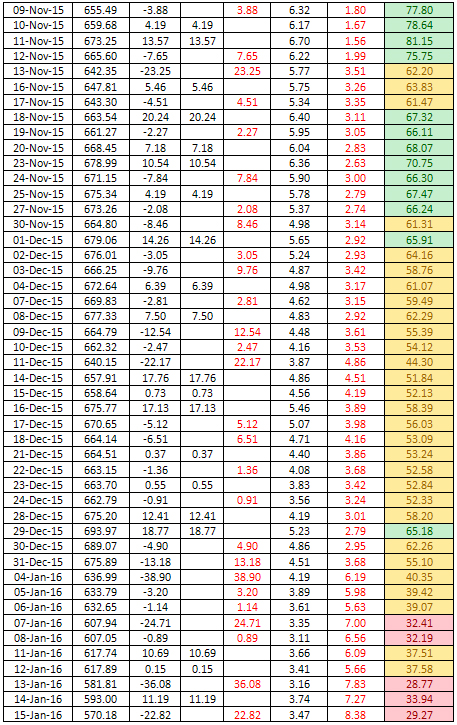

Table 1 shows the Relative Strength

Index for each day on the basis of

14-day RSI technique from 1st April

2015 to 15th January 2016.

Table 1: Showing Relative Strength

Analysis on the basis of 14-day RSI

In this paper, signals are only tak

en in the direction of the trend with

the following conditions:

• Go long, in an up-trend, when

RSI falls below 35 and rises back

above it.

• Go short, in a down-trend,

when RSI rises above 65 and falls

back below it.

In the column of 14-day RSI in Table

1, the red cells show oversold zones,

green cells show overbought zones

and yellow cells show hold position.

According to Wilder, divergences signal

a potential reversal point because

directional momentum does not confirm

price. A bullish divergence occurs

when the underlying security makes

a lower low and RSI forms a higher

low. RSI does not confirm the lower

low and this shows strengthening momentum.

A bearish divergence forms when the

security records a higher high and

RSI forms a lower high. RSI does not

confirm the new high and this shows

weakening momentum.

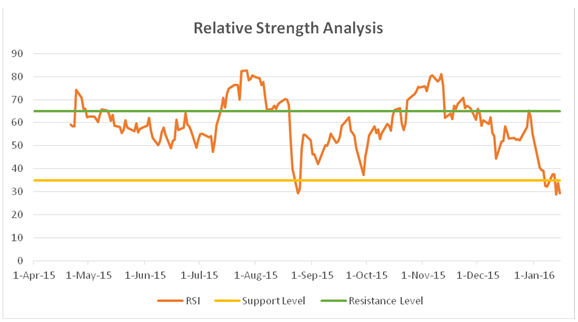

Chart 1: Showing Relative Strength

Analysis with Support & Resistance

Levels

RSI forms patterns, such as triangles

or head and shoulders tops and bottoms.

Breakouts from these patterns on the

daily chart often precede the price

breakout by one or two days -- providing

the swing trader valuable advance

notice. Chart 1 shows Amazon.com,

Inc. with a bullish divergence in

the first month of financial year

(April 2015) showing the stock in

overbought zone on 24th April 2015.

Then suddenly for a week from 30.04.2015

to 07.05.2015, the stock formed a

bearish divergence to some extent

for saving the stock from overbought

zone. After two days the stock again

came in normal mode. Then, the stock

price moved to new high from mid-July

to mid-August 2015 as well as RSI

formed a bullish divergence which

further leads to crossing of resistance

level, showing overbought zones.

But on 20th August 2015, suddenly

all the investors start selling the

shares of the company and the shares

came in oversold zones within two

trading days and the scrip gave clear

indication of buying as it is expected

that prices will definitely increase

in the near future. During the above

mentioned two-days, the prices of

the shares fall by US$69.55 from US$532.92

to US$463.37 per share. The prices

fell down suddenly during this period

due to the news spread all over about

the 'brutal' work treatment in Amazon

which became headlines of leading

newspapers and news channels viz.

CNN Money(6),

New York Times(7),

BBC News(8,9),

Washington Post(10),

etc.

The indication of buying of shares

as shown by RSI values comes to practical

ground when on 26th August 2015, the

share price again rose to US$500.77

per share and US$518.37 per share

on 27th August 2015. The prices of

the shares moved to US$548.39 per

share till 21st September 2015 which

generated huge profits for the investors

who invested on those two trading

days near 20th August 2015. During

this period, the RSI values formed

various bullish and bearish divergences

but all trading were in the range

of 35 and 65. Then on 23rd of October

2015, the RSI values again showed

overbought zones due to high demand

of investors over previous days. The

stock was in overbought zones till

around 1st December 2015 and then

the prices moved to normal position.

But, now since 7th January 2016, the

stock is showing in oversold zones,

i.e. the investors are selling its

shares in a huge amount. On the last

trading day of period concerned i.e.

on 15th January 2016, the prices of

the shares fell by US$22.82 per share.

6. http://money.cnn.com/2015/08/17/technology/amazon-nytimes/

7. http://www.nytimes.com/2015/08/16/technology/inside-amazon-wrestling-big-ideas-in-a-bruising-workplace.html?_r=0

8. http://www.bbc.com/news/business-33957484

9. http://www.bbc.com/news/magazine-33988479

10. https://www.washingtonpost.com/news/the-switch/wp/2015/08/17/is-it-really-that-hard-to-work-at-amazon/

6. Conclusion

The study was done over a period of

290 days with the help of RSI indicator

out of which the trading was opened

for 194 days, rest of the days were

weekends and other holidays on which

stock market was closed. From the

study, it was analysed that the stock

prices of Amazon.com, Inc. over a

said period of time was moved from

a period low of US$368.34 on 1st April

2015 to a period high of 696.44 on

29th December 2015 which shows a huge

positive change in market capitalisation.

It was further concluded that business

begins with value creation. It is

the purpose of the institution: to

create and deliver value in an efficient

enough way that it will generate profit

after cost because value creation

is the starting point for all businesses,

successful or not; it's a fundamental

concept to understand as proved by

the analysis, effect of timely news

and data shown.

References

Amit, R., & Zott, C. (2000). Value

creation in e-business. INSEAD.

Errunza, V. R., & Losq, E. (1985).

The behavior of stock prices on LDC

markets. Journal of Banking &

Finance, 9(4), 561-575.

Gunasekarage, A., & Power, D.

M. (2001). The profitability of moving

average trading rules in South Asian

stock markets. Emerging Markets Review,

2(1), 17-33.

Hameed, A., & Kusnadi, Y. (2002).

Momentum strategies: Evidence from

Pacific Basin stock markets. Journal

of financial research, 25(3), 383-397.

Jegadeesh, N., & Titman, S. (1993).

Returns to buying winners and selling

losers: Implications for stock market

efficiency. The Journal of finance,

48 (1), 65-91.

Pan, R. K., & Sinha, S. (2007).

Collective behavior of stock price

movements in an emerging market. Physical

Review E, 76(4), 046116.

Pruitt, S. W., & White, R. E.

(1988). The CRISMA trading system:

Who says technical analysis can't

beat the market?. The journal of portfolio

management, 14(3), 55-58.

Tsaih, R., Hsu, Y., & Lai, C.

C. (1998). Forecasting S&P 500

stock index futures with a hybrid

AI system. Decision Support Systems,

23(2), 161-174.

Wang, C. (2004). Relative strength

strategies in China's stock market:

1994-2000. Pacific-Basin Finance Journal,

12(2), 159-177.

Wong, W. K., Manzur, M., & Chew,

B. K. (2003). How rewarding is technical

analysis? Evidence from Singapore

stock market. Applied Financial Economics,

13(7), 543-551.

|