|

The impact of advance management accounting

techniques on performance: The case

of Malaysia

Abdullah Mohamed Ahmed Ayedh (1)

Chaabane Oussama Houssem Eddine (2)

(1) Universiti Sains Islam Malaysia,

Department of Accounting

(2) International Islamic University

Malaysia, Department of Accounting

Correspondence:

Chaabane Oussama Houssem Eddine

International Islamic University Malaysia,

Department of Accounting

Malaysia

Email:

Oussama.ch33@yahoo.fr

Abstract

Purpose:

The paper aims to examine the adoption

of several Advance Management Accounting

(AMA) techniques (i.e. total quality

management (TQM), activity based costing

(ABC), the ISO 9000 certificate, the

balanced scorecard (BSC), strategic

management (SMA), value based management

(VBM), and benchmarking) by the listed

companies on Bursa Malaysia (i.e.

the Malaysian stock exchange). In

addition, the paper examines the impact

of the adopted AMA techniques on a

company's overall performance.

Design/methodology/approach:

The paper used a questionnaire survey

method to gather the required data.

The questionnaires were distributed

to senior managers of selected listed

companies. The paper used descriptive

statistic, correlation and regression

techniques to analyze the data.

Findings: The paper found that

benchmarking, balanced scorecard,

and total quality management are among

the AMA techniques widely adopted

by Malaysian listed companies. In

addition, the paper found that the

adoption of AMA techniques significantly

influenced the companies' overall

performance. More specifically, the

paper found that the adoption of balanced

scorecard significantly influenced

the companies' profitability, customer

satisfaction, market position, and

sales growth for existing services

and products.

Research limitations/implications:

This paper focused solely on seven

well-known AMA techniques. In addition,

the paper only used data collected

by a questionnaire survey.

Practical implications - The findings

of the paper provide empirical evidence

on the current adoption of AMA techniques

by Malaysian listed companies. These

findings could be considered important

and useful for advancement of companies

adopting AMA techniques to improve

their performance. On the other hand,

the findings can potentially encourage

companies yet to adopt AMA techniques

to do so in order to maximize their

potential in a highly competitive

and global corporate environment.

Originality/value: This paper

contributes to the management accounting

literature in Malaysia by identifying

the advantages of adopting the AMA

techniques, especially balanced scorecard

and benchmarking, in the Malaysian

context.

Key words: Management accounting

technique, Performance, Listed companies,

Malaysia.

1. Introduction

As a remedy to the weakness of

traditional performance measurement

models, a number of AMA systems or

techniques were introduced in the

last fifty years (Kaplan and Norton,

1992). Examples of such techniques

are total quality management (TQM),

activity based costing (ABC), ISO

9000 certificate, balanced scorecard

(BSC), strategic management accounting

(SMA), value based management (VBM),

and benchmarking (BNC). The AMA techniques

can be defined as a set of theories,

standards, actions and analytic frameworks

that aim to control and measure an

organization's performance (Rigby,

2001).

According to the International Monetary

Fund (IMF) report (2006), the Malaysian

economy is seeing continued high growth.

The Malaysian GDP has continuously

increased year by year (IMF reports,

2006; 2007). The fast growth of the

Malaysian economy along with globalization

have encouraged Malaysian companies

to adopt AMA techniques such as TQM

and BSC (Bontis et al., 2000; Naser

et al., 2004; Samat et al., 2006;

Wei and Nair, 2006) as a means to

respond to global market competition.

AMA techniques are a selection of

analytical tools to optimize the performance

of a firm (i.e. TQM, ABC, ISO 9000

certificate, BSC, SMA, VBM, and benchmarking).

Each technique provides nuanced performance

information. The BSC was defined by

Kaplan et al. (2004) as a strategic

management technique that translates

an organization's strategy into clear

objectives, measures, targets and

initiatives organized by four perspectives,

while, TQM is defined as a set of

management concepts and tools that

aim to involve managers, employees

and workers to yield continuous performance

improvement (Hoque, 2004). ABC allocates

overhead costs based on specific activities

to generate certain products or render

services (Kaplan et al., 2004). The

ISO 9000 certificate was established

in 1987 and is defined as an international

set of five related standards for

qualification of global quality assurance

and quality control standards (Yahya

and Goh, 2001; Naser et al., 2004).

The SMA is defined as a general advanced

approach to accounting for strategic

positioning (Cinquini and Tenucci,

2006). The VBM focuses on better decision-making

at all levels in an organization.

Lastly, the BNC is a process of studying

and comparing successful practices

and selecting the best for improving

an organization's performance (Letts

et al., 1999).

The paper aims to examine the adoption

of AMA techniques by Malaysian listed

companies and the impact those techniques

have on company performance. The findings

provide information from which Malaysian

listed companies can further explore,

understand and improve the role of

AMA techniques to improve their performance

in a highly competitive business environment.

The paper is organized as follows.

Section two briefly reviews the prior

literature on company performance

and adoption of AMA techniques. Section

three explains the research methodology.

Section four presents and discusses

the results and findings. Section

five concludes the paper.

2. Literature

review

There is a considerable body of literature

on issues concerning the adoption

of AMA techniques and its significance

to company performance. Generally,

companies tend to apply AMA techniques

to improve their performance (Chenhall

and Smith, 1998; Rigby, 2001; Hussain

et al., 2002; Abdel-Maksoud, 2004).

It has been argued that the AMA techniques

directly enhance performance measurement

practices (Koller, 1994; Chenhall

and Smith, 1998; Zairi, 1998; Letts

et al., 1999; Rigby, 2001; Hussain

et al., 2002; Abdel-Maksoud, 2004;

Cinquini and Tenucci, 2006). For example,

it has been found that companies that

adopt the BSC perform better than

those companies that do not (Davis

and Albright, 2004; Anand et al. 2005;

Neely, 2008). Furthermore, prior studies

found a positive relationship between

registering ISO certificates and a

company's performance (Yahya and Goh,

2001; Naser et al., 2004; Ann et al.

2006). In addition, companies adopting

the TQM often see improved performance

(Samat et al., 2006). The same was

found for benchmarking and ABC techniques

(Chenhall and Smith, 1998 and Rigby,

2001).

In USA, Davis and Albright (2003)

initiated a quasi-experimental study

to examine whether the bank branches

that implemented the BSC saw any improvement

in financial performance. They found

that branches that applied BSC performed

better than branches that did not.

Another study in the UK by Neely et

al. (2005) investigated the impact

of implementing the BSC by using a

quasi-experimental study. The result

indicated that there was a positive

improvement in sales, gross profit

and net profit, but when they compared

the sales and gross profit with a

sister organization which was using

the traditional profitability method

to measure the performance there was

no relationship. In Taiwan, Wang (2004)

examined the relationships between

a set of exchange ratios (financial

measures) and the BSC (integrated

financial and non-financial measures)

for a sample of 32 companies and acquisitions

of 14 financial holding companies.

The results also indicated that firms

practicing BSC are performing better

than firms without BSC. Anand et al.

(2005) investigated the current practices

of BSC (design and function) in Indian

organizations. They found that the

majority of the sample of Indian companies

that implemented the BSC had better

classification of cost reduction opportunities,

which leads to improvement in the

bottom line of company performance.

Samat et al. (2006) explored the practices

of TQM in two aspects, namely quality

service and market orientation based

on a questionnaire-survey. The results

indicated that employee empowerment,

information and communication, customer

focus, and continuous improvement

significantly influenced service quality,

whereas only the first two factors

(i.e. empowerment and customer focus)

had an important impact on market

orientation.

3. Research

methodology

3.1 Sample selection

This paper targeted a sample of senior

managers as respondents because they

are responsible for adopting and implementing

new accounting techniques or systems.

As such, they are ideally positioned

to provide the necessary data. This

paper focuses on Malaysian companies

listed on Bursa Malaysia (i.e. the

Malaysian stock exchange) because

they are big companies and have more

recourse to adopt the AMA techniques

compared to non-listed companies.

Although Bursa Malaysia classifies

the listed companies into sectors

(i.e. industries), the current paper

has used the cross-sectional research

method that selects companies regardless

of industry or sector. At the time

of the study, a total of 891 companies

were listed on the Bursa Malaysia

website. A random sampling method

was used to select the required companies,

which resulted in a sample of 234

companies.

3.2 Data collection

Data was collected through the questionnaire

survey method. The questionnaire was

developed from the prior research

of Kald and Nilsson (2000), Speckbacher

et al. (2003), Evans (2004) and Anand

et al. (2005). Some modifications

were made to simplify certain terminologies

used in the questionnaire. In addition,

the differences of location and environment

of the research were considered and

controlled accordingly. The questionnaire

was comprised of three sections. The

first section obtains the performance

measurement practices in organizations.

The second section obtains the managers'

perceptions of the performance of

the company over the past five years.

The third and final section obtains

the demographic information of the

respondents.

A pilot test was conducted before

distributing the actual questionnaires

in order to enhance the reliability

of the survey. The pilot questionnaires

were disturbed to a group of academics

and five listed companies. The questionnaire

was then modified based on the feedback

and suggestions received.

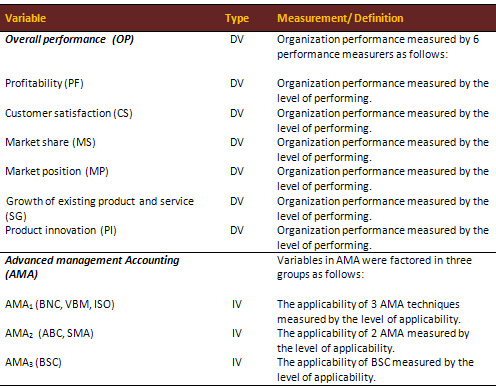

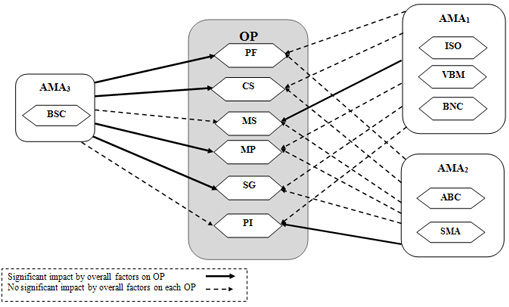

Prior to the regression analysis,

factor analysis was conducted to summarize

or reduce the data to obtain the most

influential group of variables regarding

performance. The factor analysis resulted

in the following three groups. The

first group is AMA1, which includes

BNC, VBM, and ISO. The second group

is AMA2, which consists of ABC, SMA.

The third group is AMA3, which represents

BSC. In addition, six performance

components (i.e. profitability, customer

satisfaction, market share, market

position, growth of existing product

and service and product innovation)

are factored under overall performance

(OP). Table 1 shows the measurements

and definitions of the variables used

in the paper.

Table 1: Variables measurement

and definition

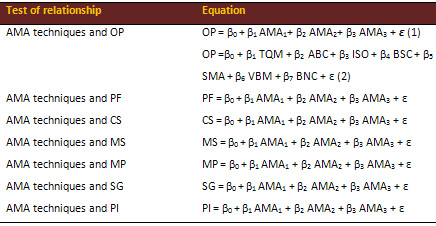

For satisfactory results, the paper

applied a stepwise regression model

to examine the influence of AMAs (i.e.

independent variable) on the company's

performance (i.e. dependent variable).

The first stage in the stepwise regression

assesses the impact of the adoption

of AMAs on overall performance. The

second stage focuses on the impact

of the adoption of AMAs on each component

of organizational performance (profitability

(PF); customer satisfaction (CS);

market share (MS); market position

(MP); growth of existing product and

services (SG); product innovation

(PI). The equations of the regression

models are specified in Table 2 as

follows:

Table 2: Regression equations

4. Findings

and discussion

4.1 Survey and respondents' background

The questionnaire was divided into

two stages. In the first stage, the

questionnaires were sent to all 234

companies through mail (117 companies),

e-mail (84 companies) and fax (33

companies) to avoid any bias in the

distribution process. In the second

stage, two weeks after finishing the

first stage, all companies in the

sample population received a call

from the researcher or his assistants

to confirm receiving the mail, e-mail

and fax requesting their participation.

A total of 65 questionnaires were

received of which 50 questionnaires

were useable. A response rate of 21.4

percent was obtained which can be

considered an acceptable rate for

that sample size (Sekaran, 2003).

In regards to the respondents' background,

the majority of respondents are upper

or middle management with more than

2 years' experience. Such conditions

provide logical assurance of the validity

of the responses.

4.2 Reliability tests

Reliability and validity tests were

conducted based on the normality and

multi-collinearity of variables (Sekaran,

2003). The results indicate that the

variables are reliable. In addition,

a non-response bias test for the late

response was conducted by comparing

the mean of the first and last ten

on the data. The results showed that

there was no such problem.

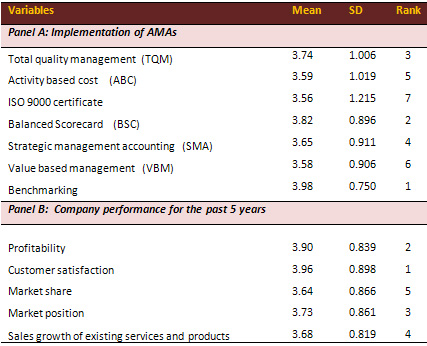

4.3 Descriptive statistics

Table III, panel A shows the descriptive

statistics of the implementation of

AMA techniques. Based on the mean,

the most popular AMA technique is

benchmarking. This finding is similar

to the findings of studies in Europe

and US (e.g. Hussain et al., 2002;

Abdel-Maksoud, 2004; Evans, 2004).

This is followed by the balanced scorecard,

total quality management, ISO 9000

certificate, value based management,

activity based costing and strategic

management accounting techniques respectively.

Comparing these findings with Sulaiman

et al.'s (2004) revealed that only

28 percent of companies used ABC.

In addition, Malaysian companies gradually

adopted the BSC. This result indicates

that Malaysian companies are increasingly

implementing the AMA techniques, which,

as suggested by Samat et al. (2006),

is partly the result of the steady

growth of the Malaysia economy and

efforts to attract international companies

to Malaysia that implement AMA models.

Panel B of Table 3 presents how managers

perceived company performance for

the past five years in terms of profitability,

customer satisfaction, market share,

market position and sales growth of

existing services and products. The

table shows that managers perceived

customer satisfaction and profitability

respectively as the most important

indicators of company performance.

However, managers did not perceive

the market share as an important indicator

of company performance.

Table 3: Descriptive statistics

4.4 Regression analysis

As mentioned earlier, the main

objective of the regression is to

examine the impact of AMA techniques

on a company's performance. Prior

to running the regression analysis,

the paper performed normality and

multi-collinearity tests to ensure

the data is normally distributed and

to check the requirements of running

the regression analysis are met. The

results of these tests show that the

data was normally distributed and

there were no multi-collinearity problems.

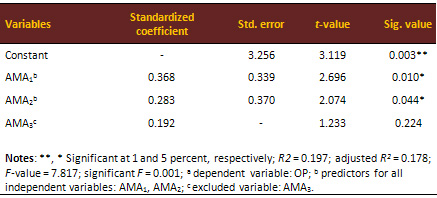

4.4.1 Overall performance

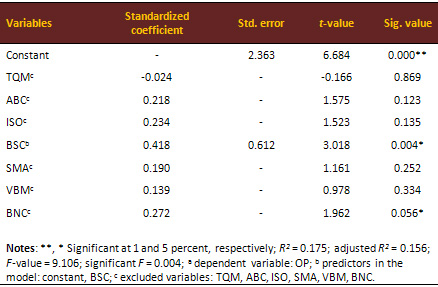

Table 4 shows the results of the

first regression model that tests

the relationship between the applicability

of AMAs in the sampled companies and

the Overall Performance (OP).

The results show that the AMA1

and AMA2 are

significant. The results from Table

IV revealed that the AMA1

and AMA2 significantly

influence the OP with the exception

of BSC. This finding is consistent

with most prior studies (e.g. Yahya

and Goh, 2001; Ann et al. 2006) Since

only the first two groups of AMA were

significant, it would be interesting

to examine the impact of each AMA

technique, i.e. TQM, ABC, ISO, BSC,

SMA, VBM, and BNC, on OP.

Table 4: Regression analysis results

of overall performance

Table 5 shows that the BSC significantly

influences OP. The result suggests

that when each AMA works individually

to improve performance, BSC is the

most effective technique. This finding

is consistent with some prior studies

(e.g. Davis and Albright, 2004; Anand

et al. 2005; Neely, 2008).

Interestingly, BSC has no significant

impact on OP when it is regressed

with other AMA techniques. However,

when each AMA technique is regressed

with OP, only BSC and benchmarking

significantly influence the OP. In

addition, the study further tests

the impact of the adoption of AMA

techniques with each performance indicator

(i.e. PF, CS, MS, MP, SG, and PI).

The following section analyzes and

discusses these findings.

Table 5: Regression analysis results

of overall performance

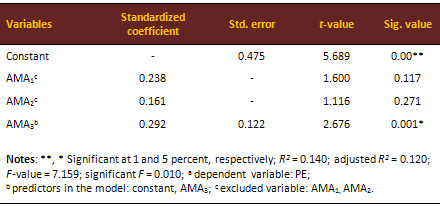

4.4.2 Profitability

As a dependent variable the PF has

been regressed with the AMA techniques.

The results are presented in Table

6. The results show that only AMA3

(i.e. BSC) has a significant impact

on PF (b=0.292,

p=0.010). This shows that the importance

of BSC in improving the organizational

performance, especially financial

indicators.

Table 6: Regression analysis results

of profitability a

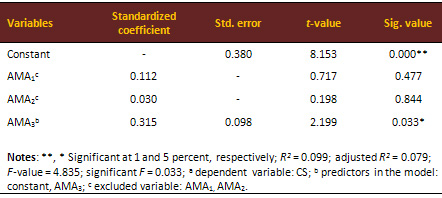

4.4.3 Customer

satisfaction

Table 7 reports the result of the

regression analysis that tests the

relationship between CS and AMA techniques.

The results reveal that only BSC influences

CS significantly (b

=0.315,

p=0.033), whereas other AMAs did not.

The possible reason for this could

be that customer perspective is one

of the BSC's indicators, and as such,

it seems that adopting BSC has a significant

impact on customer satisfaction.

Table 7: Results of regression

analysis of customer satisfactiona

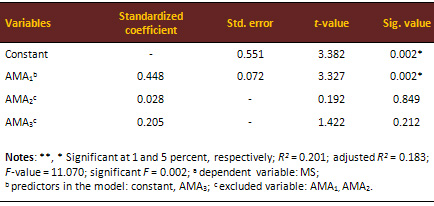

4.4.4 Market share

Table 8 presents

the results of the regression analysis

of the relationship between the MS

and the AMA techniques. The results

indicate that only AMA1

(BNC, VBM, ISO) influences MS significantly

(b =0.448,

p=0.002), whereas other AMAs did not.

The possible explanation of this result

is that AMA1 techniques are related

to the competitive perspective especially

BNC and ISO that are logically related

to the market share performance indicator.

Surprisingly, the results with respect

to AMA1 (BSC)

had no significant impact on MS although

it is logically related.

Table 8: Regression analysis results

of market shares

a

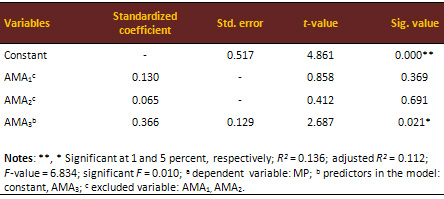

4.4.5 Market position

Table 9 shows the regression analysis

results of the relationship between

the MP and AMA techniques. The result

reveals that AMA3

(i.e. BSC) had a significant impact

on MP (b

=0.366, p=0.021), while there was

no significant impact when applying

other AMAs on MP. In other words,

it can be said that implementing the

BSC leads to an improved market position

of the organization.

Table 9: Regression analysis results

of market position a

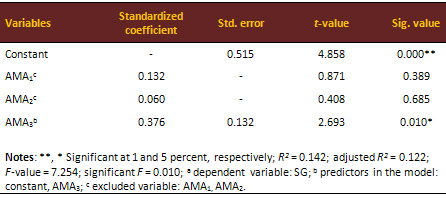

4.4.6 Sales growth of existing

services and products

Table 10 reports the result of the

regression analysis of the relationship

between SG and AMA techniques. The

results indicates that only AMA3

(i.e. BSC) significantly impacted

on SG (b

=0.376, p=0.010). In other

words, one advantage of the implementation

of BSC is the improvement of the sales

growth for existing services and products

of the company. A possible explanation

of this result is that BSC is financial

and non-financial measure of performance.

The non-financial measures such as

customer stratification might impact

the sales of the companies by taking

customers' feedback into consideration.

Table 10:

Regression analysis results of sales

growth a

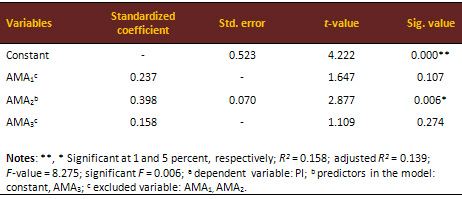

4.4.7 Product innovations

Table 11 shows the results of the

regression analysis on the relationship

between PI and AMA techniques. The

results show that AMA2

has a significant influence on PI

(b =0.398,

p=0.006). This result shows the importance

of ABC and SMA by ensuring that management

is provided with the necessary environment

for product innovation.

Table 11: Regression analysis results

of product innovations a

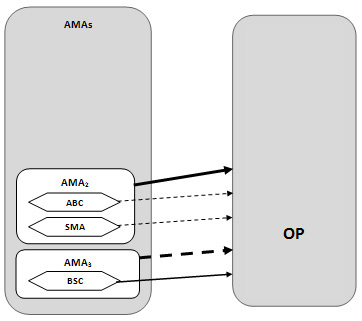

In order to simplify the result of

the regressions presented above, all

the regression results discussed are

presented into a diagram as illustrated

in Figures 1 and 2 below.

Figure 1: Regressions of overall

performance and AMAs

Figure 2: Regressions of specific performance

and AMAs

5. Conclusion

The main aim of this study is to explore

the relationship between the applicability

of AMA and performance. This study found

that applying AMA1 (ISO, VBM, and BNC)

and AMA2 (ABC and SMA) has significant

impact on the overall company's performance.

Examining company performance through

the collective application of all techniques

could generate stronger impact on company

performance than the BSC alone. In addition,

adopting balanced scorecard significantly

influenced company profitability, customer

satisfaction, market position, and sales

growth for existing services and products.

Despite certain limitations in this

study, namely that the study examined

only seven advanced managerial accounting

techniques, which are well-known in

literature, companies may nevertheless

initiate improvement programs that do

not fall into the specific well-known

packages, which may also affect the

design of the performance measurement

system. Second, this study found a significant

increase in the adoption of AMAs, which

had greater focus on nonfinancial performance

measures as compared to the previous

study by Sulaiman et al. (2004). However,

Ayedh and Muslim (2009) found that performance

measurement systems (PMSs) of many companies

mainly focus on financial performance.

These findings may indicate that Malaysian

companies are adopting AMAs for the

sake of mimicking. Therefore, to gain

greater understanding on this matter,

further research could be undertaken

using the case study approach under

the new institutional sociology perspective.

References

Abdel-Maksoud A. (2004), "Manufacturing

in the UK: Contemporary characteristics

and performance indicators",

Journal of Manufacturing Technology

Management, Vol. 15 No. 2, pp. 155-171.

Anand, J., Sahay, B., and Saha, S.

(2005), "Balanced Scorecard in

Indian Companies", Vikalpa, Vol.

30 No. 2, pp. 11-25.

Ann, G., Zailani, S., and Wahid,

N. (2006), "A study on the impact

of environmental management system

(EMS) certification towards firms'

performance in Malaysia", Management

of Environmental Quality: An International

Journal, Vol. 17 No. 1, pp. 73-93.

Ayedh, A., Muslim, M. (2009), "Performance

measurement practices in the Malaysian

companies: An exploratory study",

paper presented at the First International

Conference of Finance, Business &

Accounting, Kuala Lumpur.

Bontis, N., Keow, W.C.C. and Richardson,

S. (2000), "Intellectual capital

and business performance in Malaysian

industries", Journal of Intellectual

Capital, Vol. 1 No. 1, pp. 85-100.

Chenhall, R. and Smith, K., (1998),

"Adoption and benefits of management

accounting practices: an Australian

study", Management Accounting

Research, Vol. 9, pp. 1-19.

Cinquini, L. and Tenucci, A. (2006),

"Strategic Management Accounting:

Exploring distinctive features and

links with strategy", MPRA, paper

No. 212. Available at http:// mpra.ub.uni-muenchen.de/212/

(accessed 10 March 2009).

Davis, S. and Albright, T. (2004),

"An investigation of the effect

of Balanced Scorecard implementation

on financial performance", Management

Accounting Research, Vol. 15, pp.

135-153.

Evans, J. (2004), "An exploratory

study of performance measurement systems

and relationships with performance

results", Journal of Operations

Management, Vol. 22, pp. 219-232.

Hussain, M., Gunasekaran, A., and

Islam, M. (2002), "Implications

of non-financial performance measures

in Finnish banks", Managerial

Auditing Journal, Vol. 17 No. 8, pp.

452-463.

IMF International Mandatory Fond

report (2007). Retrieved May 9, 2007,

available at:

http://www.imf.org/external/pubs/ft/ar/2007/eng/index.htm

IMF International Mandatory Fond

report (2006). Retrieved May 9, 2007,

available at:

http://www.imf.org/external/pubs/ft/ar/2006/eng/index.htm

Hoque, Z. (2004) "A Contingency

Model of The Association Between Strategy,

Environmental Uncertainty and Performance

Measurement: Impact on Organizational

Performance." International Business

Review 13.

Kald, M. and Nilsson, F. (2000),

"Performance measurement at Nordic

companies", European Management

Journal, Vol. 18 No. 1, pp. 113-127.

Kaplan, R.S. and Norton, D.P. (1992),

"The balanced scorecard: Measures

that drive performance", Harvard

business review, Vol. 70 No. 1, pp.

71-9.

Koller, T. (1994), "What is

value-based management? An excerpt

from Valuation: Measuring and Managing

the Value of Companies", McKINSEY,

No. 3, quarterly second edition.

Letts, C., Ryan, W. and Grossman,

A. (1999), "Benchmarking: How

non-profits are adapting a business

planning tools for enhanced performance.

Available at http://www.tgci.com/magazine/Benchmarking.pdf

(accessed 21 March 2011).

Naser, K., Karbhari, Y., and Mokhtar,

M. (2004), "Impact of ISO 9000

registration on company performance:

Evidence from Malaysia", Managerial

auditing journal, Vol.19 No.4, pp.

509-516.

Neely, A. (2008), "Does the

Balanced Scorecard work: An empirical

investigation". Working paper

series, available at http://dspace.lib.cranfield.ac.uk/handle/1826/3932

(accessed 21 March 2011).

Rigby, D. (2001), "Management

Tools and Techniques: A survey",

California Management Review, Vol.

43 No. 2, pp. 139-160.

Samat, N., Ramayah T. and Saad N.

(2006), "TQM practices, services

quality, and market orientation: Some

empirical evidence from a developing

country". Management Research

News, Vol. 29 No. 11, pp. 713-728.

Speckbacher, G., Bischof, J., and

Pfeiffer, T. (2003), "A descriptive

analysis on the implementation of

Balanced Scorecards in German-speaking

countries", Management Accounting

Research, Vol. 14 No.4, pp. 361-387.

Sekaran, U. (2003), Research Methods

for Business a skill building approach,

John Wiley and Sons, Inc, Canada.

Sulaiman, M., Nik A., and Alwi, N.

(2004), "Management accounting

practices in selected Asian countries"

Managerial Auditing Journal, Vol.

19 No. 4, pp. 493-508.

Wang, W. (2004), "An evaluation

of the balanced scorecard in equity

valuation: The case of exchange ratio

in the M&As of Taiwan's financial

industry. Journal of intellectual

capital Vol. 6 No. 2, pp. 206-221.

Wei, K. and Nair, M. (2006), "

The effects of customer services management

on business performance in Malaysian

banking industry: an empirical analysia",

Asia Pacific Journal of Marketing

and Logistics, Vol. 18, No. 2, pp.

111-128.

Zairi, M. (1998), "Benchmarking

at shorts", Benchmarking for

Quality Management and Technology,

Vol. 5 No. 1, pp. 13-20.

Yahya, S. and Goh, W. (2001), "The

implementation of an ISO 9000 quality

system", International Journal

of Quality and Reliability Management,

Vol. 18, No. 9, pp. 941-966.

|