|

Does

Corporate Social Responsibility Expenditure

Affect Financial Performance of Islamic

Banks in Bangladesh?

Mehedi Hasan Tuhin

Correspondence:

Mehedi Hasan Tuhin

Assistant Professor

Dept. of Business Administration

Sylhet International University

Shamibabad, Bagbari, Sylhet, Bangladesh.

Email: mehedi_siu@yahoo.com

Abstract

The aim of this study is to measure

the impact of corporate social responsibility

(CSR) expenditure on Islamic banks'

financial performance in Bangladesh.

The Return on Asset (ROA) and Return

on Equity (ROE) are used as proxy

for financial performance of bank

for this study. The data of CSR expenditure

and the performance variable are collected

from all seven full-fledged Islamic

banks in Bangladesh for the period

2007-2011. The simple regression analysis

is applied to test the association

between CSR expenditure and the bank's

financial performance. The results

show that there is no significant

impact of CSR expenditure on Islamic

banks' financial performance.

Keywords: Corporate Social

Responsibility; Financial Performance;

Islamic Banks; Bangladesh.

1. Introduction

Corporate Social Responsibility (CSR)

has become an issue of global concern.

CSR is the process by which an organization

evolves its relationships with stakeholders

for the common good. Social responsibility

means not only fulfilling legal expectations,

but also going beyond compliance to

fulfill social needs. Through CSR

corporate entities visibly contribute

to the social good. Thus CSR is no

charity or mere donations. Socially

responsible companies use CSR to incorporate

economic, environmental and social

objectives with the company's operations

and development.

CSR activities practiced by banks

can create awareness about banking

activities and increase loyalty among

customers, depositors, and employees

of the bank. The banking sector contributes

to the society as part of CSR in the

form of education, health, and environment

etc which can stimulate sustainable

economy developments. Through CSR

activities, a bank overcomes the barrier

between bank and society. As a result,

both deposit and investment improves

with the increase of CSR expenditure.

On the other hand, implementing CSR

activities is costly for banks and

it enhances the total cost which might

reduce the impact of CSR activities

on the banks' profit in the short-run.

Though the cost of the banks enhances

with the CSR activities in the long

run it has a good impact on a bank's

performance. CSR builds up stakeholders'

confidence and creates a good corporate

image of the bank.

CSR activities are relevant with

Islamic laws. As per Islamic Shariah

all Islamic financial institutions

should be involved and perform social

responsibility to the society. According

to Sadeq (2007) the prime objectives

and functions of Islamic banks are

the betterment of general human being;

bringing about social and economic

benefits to the Islamic world; making

brotherhood, social equality and equitable

distribution in Muslim societies;

establishment of distributive justice;

development and support of small scale

enterprises; discharging of corporate

social responsibility, including its

disclosure. Farook (2007) identified

the three major foundational principles

for Islamic Corporate Social Responsibility

i) The principle of vicegerency ii)

The principle of divine accountability

iii) The principle of enjoining good

and forbidding evil. In the view of

Sairally (2005), Islamic banks should

be accountable not only to the success

of the industry but also towards the

community, on top of being responsible

to Allah. In other words, to be consistent

with the objective of Islamic moral

economy, Islamic banks need to realize

social responsibility in order to

promote socio-economic development.

In the context of Bangladesh, the

practice of CSR prevails in the banking

sector of Bangladesh. Islamic banks

can play a significant role towards

stakeholder and towards the society

through CSR activities. But do CSR

activities have any positive or negative

impact on their financial performance?

In this paper I have tried to find

out the answer of this question. Many

studies have been conducted and various

arguments have been made regarding

the relationship between financial

performance and CSR. However, the

existing evidence is inconclusive

and hence there is need for more studies

to provide research evidence in this

context.

CSR activities are in a naive stage

and proper application of CSR is not

present at this moment in Bangladesh.

Therefore, the findings of this study

would be helpful to the society, depositors,

investors, employees, and decision

makers regarding the impact of CSR

on Islamic Bank's performance. It

is expected that the study would enrich

the existing literature by providing

empirical evidence from Bangladesh

in this regard.

The remainder of this paper is organized

as follows. Section two outlines the

research objectives of the study.

Literature review and hypotheses development

are discussed in section three and

four. Section five describes research

method. Section six discusses findings

of the study and section seven makes

concluding remarks of the study.

2. Objectives

The main aim of this study is to measure

the impact of CSR expenditure on the

financial performance of Islamic Banks.

To achieve the objective, two sub-objectives

have been set which are as follows:

1. To find the relationship between

CSR expenditure and ROA of the Islamic

banks.

2. To find the relationship between

CSR expenditure and ROE of the Islamic

banks.

3. Literature Review

A number of studies have been carried

out in both developed and developing

countries to measure the impact of

CSR on banks' financial performance.

Margolis, Elfenbein and Walsh (2009)

stated that there are more than 200

published studies on this subject

and yet there is no clear consensus

on the relationship between CSR and

corporate financial performance.

Wright and Ferris (1997) found a negative

relationship between CSR and financial

performance of a firm but Posnikoff

(1997) reported a positive relationship

and McWilliams and Siegel (2000) found

inconsistent results regarding the

relationship between CSR and short

run financial returns. Teoh, Welch

and Wazzan (1999) found no relationship

between CSR and financial performance.

Konar and Cohen (2001) argued that

a firm with a better environmental

performance has a significant positive

impact on its market value. According

to Dam (2006), there are in fact strong

linkages between corporate social

responsibility and financial performance.

Fauzi (2009) found that CSR has no

effect on financial performance. Arshad,

Othman and Othman (2012) stressed

the impact of CSR on Malaysian Islamic

banks' performance and found that

CSR was significantly positively related

to firm performance as measured by

ROA and ROE. Samina (2012) found a

strong positive correlation between

CSR Expenditure and Bangladeshi Islamic

banks' performance (Investment, Deposit,

Profit). Weshah, Dahiyat, Awaad, &

Hajjat (2012) found a significant

positive relationship between (CSR),

bank size, the level of risk in the

bank on one hand and financial performance

on the other hand in the Jordanian

banking companies. Islam, Ahmed and

Hasan (2012) revealed that the average

return on asset ratios of the banks

having high Corporate Social Performance

(CSP) is higher compared to that of

the banks having low CSP, though this

could not be proved statistically.

Hossain and Alam (2012) indicate that

the relationship between investment

in CSR and market price per share

is statistically significant; on the

contrary the relationship between

investment in CSR and net asset value

per share is not statistically significant

at 5% level of significance. Malik

and Nadeem (2012) verified the relationship

between EPS, ROA, ROE, Net Profit

and CSR using regression models and

found that there is positive relationship

between profitability (EPS, ROA, ROE,

and Net Profit) and CSR. Flammer (2013)

argues that adopting a CSR-related

proposal leads to superior financial

performance.

4. Hypotheses

Based on objectives of the study two

specific hypotheses have been formulated.

Hypothesis 1: There is positive

correlation between CSR expenditure

and ROA of the Islamic banks.

Hypothesis 2: There is positive

correlation between CSR expenditure

and ROE of the Islamic banks.

5. Methodology

Out of banking institutions, the study

concentrates only on the listed Islamic

Shariah-based banks in Bangladesh.

On December 31, 2012 there were 7

full-fledged Islamic banking companies

listed on Dhaka Stock Exchange (DSE)

and Chittagong Stock Exchange (CSE).

All seven banking companies listed

on the DSE and CSE are selected. The

study is based on secondary data.

Necessary data have been collected

from annual reports, web-sites and

publications of Bangladesh Bank. The

period of the current study covers

five years from 2007 to 2011.

Model Development

To investigate the impact of CSR expenditure

on ROA, it is assumed that-

Y1= a+b1x1

Where, Y1 = ROA in terms of percentage,

a= constant term,

b1 = Regression coefficients for the

independent variable,

x1 = CSR expenditure in BD Taka

Here, Y1 (i.e. ROA) is the dependent

variable, while the x1 is the independent

variable.

To investigate the impact of CSR

expenditure on ROE, it is assumed

that-

Y2= a+b2x2

Where, Y2 = ROE in terms of percentage,

a= constant term,

b2 = Regression coefficients for the

independent variable,

x2 = CSR expenditure in BD Taka

Here, Y2 (i.e. ROE) is the dependent

variable, while the x2 is the independent

variable.

6. Findings

6.1 Descriptive Statistics

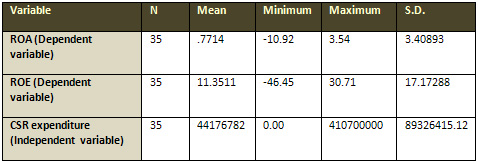

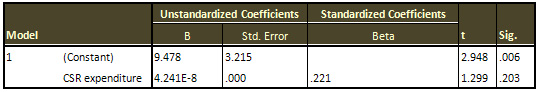

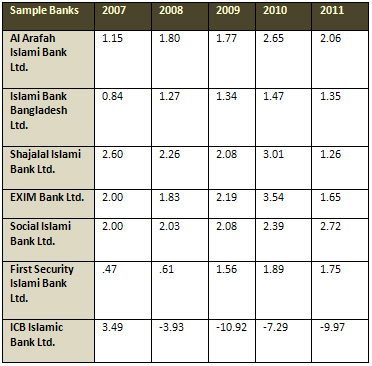

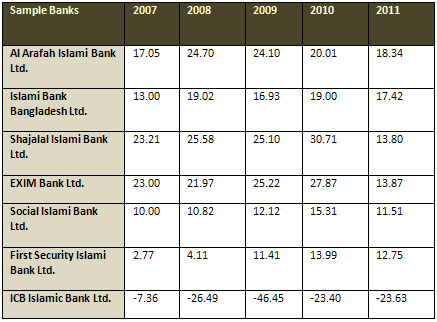

Table 1 reports the descriptive statistics

of the ROA, ROE and CSR expenditure

of sample banks. The table indicates

that the mean of CSR expenditure is

about 44176782 BD Taka. It also shows

that the extent of CSR expenditure

has a considerable range. While the

minimum is 0.00 BD Taka, the maximum

is 410700000 BD Taka. As indicated

in the table, ROA and ROE of listed

banks have also wide ranges. ROA ranges

from -10.92 % to 3.54% while ROE ranges

from -46.45% to 30.71%.

Table 1: Descriptive Statistics

for Independent and Dependent Variables

6.2 Regression Analysis

6.2.1

CSR Expenditure and ROA

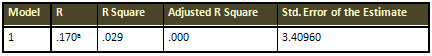

The results of the regression analysis

of the association between ROA and

CSR expenditure of listed Islamic

banks are documented in the following

section.

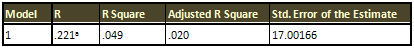

Table 2: Regression Results

Panel A: Model Summary

a. Predictors: (Constant), CSR expenditure

Panel B: ANOVAa

a. Dependent Variable: ROA

b. Predictors: (Constant), CSR expenditure

Panel C: Coefficientsa

a. Dependent Variable: ROA

The above table reveals that F value

is not significant at .328 level.

This indicates that the variation

caused by CSR expenditure in the ROA

is not significant.

The value of Correlation Coefficient

(R) and Coefficient of Determination

(R square and Adjusted R square) of

the model are also shown. The value

of correlation coefficient is .170

and R square is .029. These show that

the independent variable under reference

has very low degree of correlation

with ROA. According to the results,

we can conclude that CSR expenditure

of Islamic banks have no significant

influence on their financial performance

measured by ROA. Thus, Hypothesis

1 is not supported.

6.2.2 CSR

Expenditure and ROE

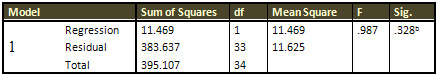

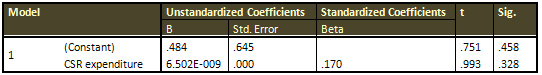

The results of the regression analysis

of the association between ROE and

CSR expenditure of listed Islamic

banks are documented in the following

section.

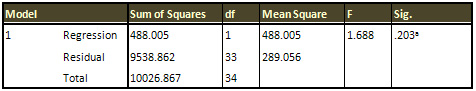

Table 3: Regression results

Panel A: Model Summary

a. Predictors: (Constant), CSR expenditure

Panel B: ANOVAb

a. Predictors: (Constant), CSR expenditure

b. Dependent Variable: ROE

Panel C: Coefficientsa

a. Dependent Variable: ROE

The above table reveals that F value

is not significant at .203 level.

This indicates that the variation

caused by CSR expenditure in the ROE

is not significant.

The value of Correlation Coefficient

(R) and Coefficient of Determination

(R square and Adjusted R square) of

the model are also shown. The value

of correlation coefficient is .221

and R square is .049. These show that

the independent variable under reference

has a very week degree of correlation

with ROE. According to the results,

we can conclude that CSR expenditure

of Islamic banks have no significant

influence on their financial performance

measured by ROE. Thus, Hypothesis

2 is also not supported.

Ullmann (1985) stated that as there

are many variables in between CSR

and a firm's financial performance,

it is very difficult to find any significant

relationship between these two measures.

McWilliams and Siegel (2000) stated

that if any kind of relationship prevails

between CSR and financial performance,

it would disappear with incorporation

of more accurate variables such as

R&D into the economic models.

Another cause might be that CSR often

provides indirect competitive advantages

which in turn make it difficult to

measure its connection to financial

performance. These arguments are supported

from the findings of this study.

7. Conclusion

The practice of CSR in financial institutions

has brought a new dimension to the

social economic scenario of Bangladesh.

Though CSR activities are being practiced

by Islamic banks to a certain extent,

doubt remains as to whether such initiatives

could potentially lead to better performance

and sustained competitive advantage.

Previous studies have provided conflicting

results regarding the relationship

between CSR and financial performance.

Our findings from this study suggest

that CSR activities of Islamic banks

do not have significant influence

on their financial performance.

Although no significant relationship

has been found between CSR and financial

performance, the management of Islamic

banks should be committed to CSR activities

in the future as it will be a prerequisite

to attract and retain customers and

employees and thus survive in the

market. It is to be noted that performing

some CSR activities is not enough

to contribute financial performance.

Islamic banks should properly select

the right kind of CSR activities and

perform them with great care. It should

be consistent with a long-term plan

rather than a short-term business

solution.

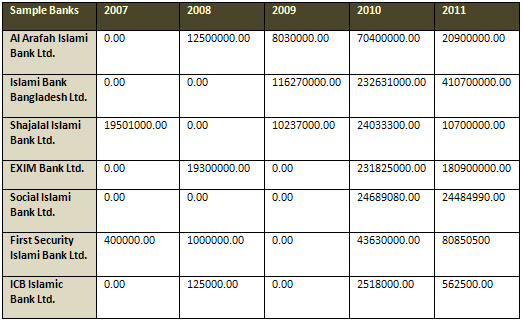

Appendices

Appendix 1: Sample Banks' CSR

Expenditure 2007-2011 (Figures in

Taka)

Source: Bangladesh Bank (2012)

Appendix 2: Sample Banks' ROA

2007-2011 (Figures in Percentage)

Source: Annual Reports 2007-2011

Appendix 3: Sample Banks'

ROE 2007-2011 (Figures in Percentage)

Source: Annual Reports 2007-2011

References

Arshad, R., Othman, S., & Othman,

R. (2012). Islamic Corporate Social

Responsibility, Corporate Reputation

and Performance. World Academy of

Science, Engineering and Technology

, 64, 1070-1074.

Dam, L. (2006). Corporate Social Responsibility

and Financial Performance. Retrieved

from http://dissertations.ub.rug.nl/FILES/faculties/feb/2008/l.dam/c2.pdf

Farook, S. (2007). On Corporate Social

responsibility of Islamic Financial

Institutions. Journal of Islamic Economic

Studies , 15 (1), 31-46.

Fauzi, H. (2009). Corporate Social

and Financial Performance: Empirical

Evidence from American Companies.

Retrieved from http://ssrn.com/abstract=1489494.

Flammer, C. (2013). Does Corporate

Social Responsibility Lead to Superior

Financial Performance? A Regression

Discontinuity Approach. Retrieved

from http://ssrn.com/abstract=2146282.

Hossain, M. E., & Alam, M. Z.

(2012). Impact of Investment in Corporate

Social Responsibility on Financial

Performances of Some Financial Institutions

Listed in Dhaka Stock Exchange. Asian

Journal of Management Sciences and

Education , 1 (2), 31-43.

Islam, Z. M., Ahmed, S. U., &

Hasan, I. (2012). Corporate Social

Responsibility and Financial Performance

Linkage: Evidence from the Banking

Sector of Bangladesh. Journal of Organizational

Management , 1 (1), 14-21.

Konar, S., & Cohen, M. (2001).

Does the Market Value Environmental

Performance? Review of Economics and

Statistics , 83 (2), 281-289.

Malik, M. S., & Nadeem, M. (2014).

Impact of corporate social responsibility

on the financial performance of banks

in Pakistan. International Letters

of Social and Humanistic Sciences

, 10 (1), 9-19.

Margolis, J. D.; Elfenbein, H. A.

and Walsh, J. P. (2009). Does it Pay

to Be Good...And Does it Matter? A

Meta-Analysis of the Relationship

between Corporate Social and Financial

Performance. Retrieved from http://ssrn.com/abstract=1866371

McWilliams, A., & Siegel, D. (2000).

Corporate Social Responsibility and

Financial Performance: Correlation

or Misspecification. Strategic Management

Journal , 21, 603-609.

Posnikoff, J. F. (1997). Disinvestment

from South Africa: They did well by

doing good. Contemporary Economic

Policy , 15 (1), 76-86.

Sadeq, A. M. (2007). Comment on Corporate

Social Responsibility Paper by Farook

and Lanis; and Sirally. Proceedings

of the 6th International Conference

on Advances in Islamic Economics and

Finance, Advances in Islamic Economic

and Finance, Islamic Research and

Training Institute, Jeddah, Saudi

Arabia.

Sairally, S. (2005). Evaluating the

'Social Responsibility" of Islamic

Finance: Learning from the experiences

of Socially Responsible Investment

Funds. Sixth International Conference

On Islamic Economics, Jakarta, Indonesia.

Samina, Q. S. (2012). Practice of

Corporate Social Responsibility in

Islamic Banks of Bangladesh. World

Journal of Social Sciences , 2 (6),

1-13.

Teoh, S. H., Welch, I., & Wazzan,

C. P. (1999). The effect of socially

activist investment policies on the

financial markets: Evidence from the

South African boycott. Journal of

Business , 72 (1), 35-89.

Ullmann, A. A. (1985). Data in Search

of a Theory: A critical Examination

of the Relationships among Social

Performance, Social Disclosure and

Economic Performance of U.S. Firms.

Academic Management Review , 10, 540-557.

Weshah, S. R., Dahiyat, A. A., Awaad,

M. R., & Hajjat, E. S. (2012).

The Impact of Adopting Corporate Social

Responsibility on Corporate Financial

Performance: Evidence from Jordanian

Banks. Interdisciplinary Journal of

Contemporary Research in Business

, 4 (5), 34-44.

Wright, P., & Ferris, S. (1997).

Agency conflict and corporate strategy:

The effect of divestment on corporate

value. Strategic Management Journal,

18 (1), 77-83.

References

|